[ad_1]

The world’s monetary markets hardly ever sit glued to their screens ready for the no-nonsense Norges Financial institution to pronounce its verdict on Norway’s financial coverage. This week was totally different. The 0.25 percentage point rise in its interest rate was essentially the most seen expression but of a turn in the monetary policy cycle that’s spreading the world over.

Not are central bankers in search of to do no matter they will to make sure cash is on the market for households, corporations and governments to borrow at exceptionally beneficial charges. Together with Norway’s financial tightening, the primary in any superior economic system for the reason that pandemic started, 4 rising economic system central banks — Pakistan, Hungary, Paraguay and Brazil — additionally raised the price of borrowing this week, whereas the US Federal Reserve and Financial institution of England each signalled a transfer in direction of tightening financial coverage.

These guardians of financial coverage are typically happy that the financial restoration has proved stronger than they feared in the beginning of the 12 months. However they’re starting to fret that cash may develop into too low cost for too lengthy. That might threaten rising inflation, extra borrowing and even financial instability because the world emerges from the coronavirus disaster.

“A normalising economic system now means that it’s acceptable to start a gradual normalisation of the coverage charge,” stated Oystein Olsen, the Norges Financial institution governor, explaining the financial institution’s resolution. Noting the rise from a flooring of zero per cent to 0.25 per cent rates of interest was unlikely to be the final, he added that as inflation rose in direction of its 2 per cent goal, a gradual programme of rate of interest rises would counter the emergence of monetary imbalances reminiscent of excessive family debt and home costs.

To totally different levels, Norway’s financial tendencies are matched throughout superior economies. Sturdy forecasts from the OECD confirmed G20 nations persevering with to get better to the purpose that it forecast they’d return to the output and employment ranges, anticipated earlier than the pandemic hit, by the tip of 2022.

In contrast with the aftermath of the 2008-09 monetary disaster, when superior economies by no means got here near eliminating the injury of the recession, the OECD’s forecasts can be a exceptional achievement.

However such is the extent of ambition this time in contrast with a decade in the past that the forecasts nonetheless didn’t fulfill the OECD’s chief economist, Laurence Boone. Many economies had excessive unemployment earlier than the pandemic, she says, particularly in Europe, and they also may “do higher”. It’s not sufficient, she provides, to easily return economies again to “the place they have been earlier than however with extra debt”.

Persistent value rises

Such excessive ambition for the worldwide economic system alongside the disruption to regular patterns of consumption in the course of the pandemic has generated a number of difficulties that not will be ignored.

Delivery prices have risen virtually fivefold for the reason that begin of 2019 with much less dramatic however equally uncommon will increase in uncooked materials and meals costs. A global semiconductor shortage has delayed deliveries of products and prevented producers from assembly shopper demand, particularly within the automotive sector. With provide chain bottlenecks and outbreaks of Covid-19 disrupting the sleek move of products, costs have begun to rise, additional including to the ugly prospect of a slower interval of development.

“That is already fairly a change from the pro-growth/commodity reflation funding mindset seen [just] a couple of months in the past,” wrote the workforce of world economists at Citi this week.

A world of stubbornly persistent value will increase and unpredictable bumps within the restoration is troublesome for central banks to cope with. Their commonplace working mode is to imagine they’ve pretty much as good an understanding of employment ranges and the manufacturing of products and providers as is feasible after which purpose to handle ranges of spending accordingly in order that inflation stays low and secure, usually focusing on a 2 per cent charge.

Within the restoration from Covid-19, with power costs rising and provide shortages changing into acute, it’s a lot more durable to have a grip on what is feasible and the possible degree of spending required in economies with coronavirus nonetheless current. So central banks should set rates of interest whereas guessing each the extent of provide and demand.

This week, the mounting proof of labour shortages and the obvious restoration in spending generated the lean towards being extra aggressive with rates of interest. The US Federal Reserve’s financial coverage assembly on Wednesday featured essentially the most specific acknowledgment but that it’s making ready to dial again the emergency assist put in place within the early days of the pandemic to stave off a way more pronounced contraction.

Jay Powell, the Fed chair, pressed forward with plans to scale back the $120bn a month asset buy programme the central financial institution had pledged to take care of till it noticed “substantial additional progress” on the twin objectives of common 2 per cent inflation and most employment. He teed up an announcement on the subsequent assembly in November to formally kick-off the “tapering” course of that may steadily cut back the purchases, and stated there was backing throughout the Federal Open Market Committee for the stimulus to be wound down totally by mid-2022.

His remarks got here with a contemporary set of particular person projections concerning the future path of US rates of interest, which confirmed that an rising variety of officers are pencilling in a charge rise subsequent 12 months. The committee is evenly cut up on a 2022 adjustment, in accordance with the projections, with at the very least three charge will increase now forecast by the tip of 2023.

“The [FOMC] has determined that as a result of inflation seems to be extra persistent and the dangers of it feeding by way of to expectations and a wage-price spiral are increased, they need to [act] a bit quicker . . . in pulling again on the lodging,” says Donald Kohn, a former Fed vice-chair now on the Brookings Establishment.

The Financial institution of England can be viewing a pointy rise in costs and disappointing development as proof that inflation is more likely to keep increased for longer — at a charge above 4 per cent for a lot of 2022 — than it had earlier predicted. That has translated right into a fear that the lack of slack in the labour market and the rise in inflation, nonetheless short-term, may feed into corporations feeling relaxed about elevating costs and wages.

Philip Rush, founding father of the consultancy Heteronomics, says there was a definite “hawkish bias” within the BoE minutes of its assembly this week. That led most economists to take the central financial institution’s phrases as a sign that it was set to begin elevating charges in February, with a slim risk that this date may even come ahead to November.

As with the Fed, the BoE’s tone was far totally different to earlier this summer time when each central banks set excessive hurdles that needed to be crossed earlier than they’d even think about tightening coverage.

The eurozone isn’t fairly in the identical place. It has a extra deep-seated downside of low inflation and 1m extra folks unemployed than in the beginning of the pandemic.

Christine Lagarde, the European Central Financial institution president, reiterated her view that inflation was “short-term” in a CNBC interview on Friday and that the outlook will “fall into place” when bottlenecks are resolved. However she additionally famous that prime power costs would stay an issue for longer and that development and inflation had picked up quicker than the ECB had anticipated.

Lagarde’s reassurance was not totally matched in tone by considered one of her vice-presidents this week. Luis de Guindos told a Financial Times online event that “there are dangers of far more persistent pressures on inflation sooner or later” particularly if the current bounce in costs, fuelled partially by the surge in power prices, feeds into increased wage calls for.

Turkey goes it alone

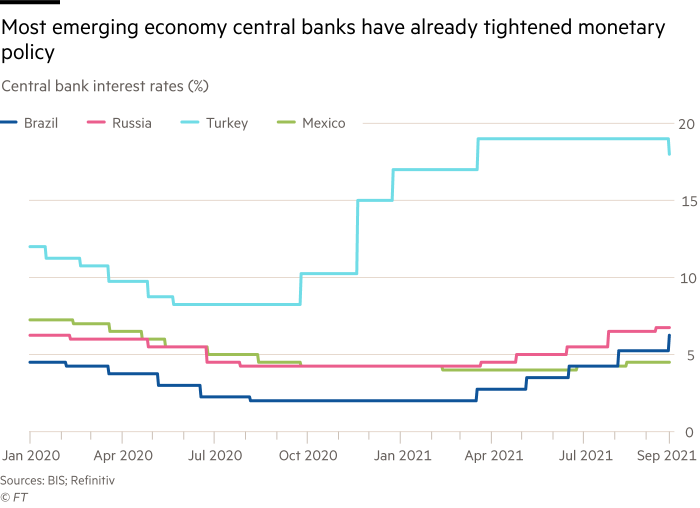

Rising economies typically do not need the luxurious of with the ability to wait and see earlier than performing. With out lengthy histories of inflation management, buyers maintain their ft nearer to the hearth and demand motion when costs begin to rise. Meals and power additionally account for a bigger share of spending and in lots of giant rising economies — Argentina, Brazil, Mexico, Russia and Turkey — the outlook has develop into troubling with the OECD saying excessive inflation was “more likely to persist for a while”.

In most of those nations, central banks have already responded with increased rates of interest. Brazil elevated its coverage charge by 1 proportion level on Wednesday to six.25 per cent, with the central financial institution blaming “increased enter prices, provide restrictions and redirecting of providers calls for in direction of items” for influencing its resolution.

An outlier from this world tilt in direction of extra restrictive financial coverage is Turkey, the place the central financial institution ignored orthodox financial views, declared inflation to be short-term and reduce rates of interest by 1 proportion level to 18 per cent, even after inflation hit 19.25 per cent in August.

Most noticed this as a politically motivated move by a central bank governor who had been positioned within the job in March after President Recep Tayyip Erdogan sacked his predecessor for clamping down too exhausting on inflation. The Turkish lira duly fell in a transfer that may squeeze home incomes additional with increased import costs. Extremely dangerous, Turkey’s economic system will now be below the highlight to see whether or not its export sector responds to the weaker lira and whether or not inflation actually is saved in verify.

Turkey was the exception this week that proved the rule. Orthodox central banks have shifted. They’ve all been shocked by how briskly inflation has picked up this 12 months and the emergence of world provide shortages as folks’s spending has shifted from providers to items. All of them hope the inflationary issues shall be short-term however with power costs rising quick, excessive inflation may persist longer than they thought just a few weeks in the past.

Even essentially the most highly effective economies on the earth now fear about inflation in a method that was unthinkable earlier within the 12 months. The bottom has shifted and financial coverage stances have turned the nook. Central banks now have a bias in direction of tightening coverage.

[ad_2]

Source