[ad_1]

Chinese language coal futures rose to file ranges as floods shut dozens of mines and displaced greater than 100,000 folks, throttling the nation’s most important supply of electrical energy and compounding a worldwide vitality disaster.

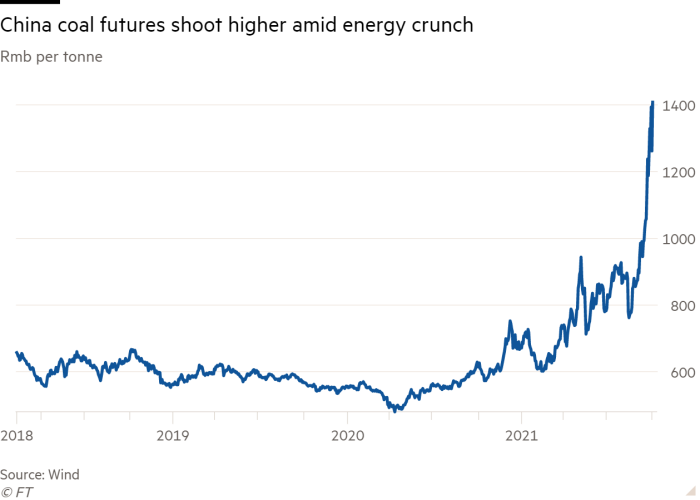

Futures traded on the Zhengzhou Commodity Alternate climbed as a lot as 11.6 per cent to an all-time excessive of Rmb1,408.20 ($218.74) a tonne early on Monday. The CSI Coal index of massive miners listed in Shanghai and Shenzhen rose as a lot as 2.1 per cent, partly reversing losses from final week, when official orders to spice up coal manufacturing despatched prices tumbling.

Flooding in Shanxi, a central province, over the weekend piled additional strain on Beijing to comprise a rising vitality disaster that threatens to undermine the recovery of the world’s second-largest financial system, because the tumult in international vitality markets has sent countries scrambling to obtain energy provides at ever-higher prices.

The overwhelming majority of China’s home coal comes from Shanxi, neighbouring Shaanxi province and the Internal Mongolia area. Local factors, together with an anti-corruption marketing campaign within the coal business and mine closures to scale back air air pollution round nationwide occasions, have led to energy rationing for industrial and, in some instances, residential customers.

“We anticipate the ability cuts and ensuing manufacturing disruptions to be momentary,” mentioned Michael Taylor, chief credit score officer for Asia-Pacific at Moody’s. “But when they proceed for an prolonged interval, corresponding to into winter, the consequences will unfold throughout the home — and probably international — financial system.”

The floods in Shanxi displaced about 120,000 folks, pressured the closure of 60 coal mines, and broken greater than 190,000 hectares of crops, in line with figures launched by the provincial authorities.

Different excessive climate occasions have additionally contributed to China’s vitality crunch, with unexpectedly dry climate within the south this 12 months hobbling hydropower manufacturing.

Beijing’s energy shortages, which have positioned stress on international provide chains, may also be ascribed to coal supply shortfalls in addition to broader coverage confusion as China rushes to satisfy ambitious green energy goals.

Excessive worldwide and home coal costs and strict caps on what producers can cost have made it financially unviable for a lot of coal-fired energy vegetation to function.

However final week, the state council, China’s cupboard, mentioned it will enable costs to rise as a lot as 20 per cent to incentivise energy manufacturing, a leap from the earlier 10 per cent restrict. Beijing additionally ordered miners to dramatically step up production.

Analysts mentioned the impression of the ructions in China’s vitality markets may unfold past international energy costs. Taylor, at Moody’s, warned that extended energy shortages in China may cut into factory output, which “may disrupt provide chains throughout Asia-Pacific given prevailing linkages, which may even improve costs alongside the chain”.

Vitality Supply weekly e-newsletter

Vitality is the world’s indispensable enterprise and Vitality Supply is its e-newsletter. Each Tuesday and Thursday, direct to your inbox, Vitality Supply brings you important information, forward-thinking evaluation and insider intelligence. Sign up here.

[ad_2]

Source