[ad_1]

About $90.1 million has mistakenly gone out to customers of well-liked DeFi staking protocol Compound after an improve gone epically unsuitable. Now, the founder is making a plea — and issuing a couple of threats — to incentivize the voluntary return of the platform’s crypto tokens.

“If you happen to acquired a big, incorrect quantity of COMP from the Compound protocol error: Please return it,” Robert Leshner, founding father of Compound Labs, tweeted late Thursday.

“Preserve 10% as a white-hat. In any other case, it is being reported as revenue to the IRS, and most of you’re doxxed,” continued the tweet.

The worth of Compound’s native token, COMP, initially plunged almost 13% in a day on information of the bug, however it’s since gained back ground.

Whether or not reward recipients select to return many tens of millions of {dollars} to the platform stays to be seen, although if historical past is any indication, it’s definitely potential.

“Alchemix [another decentralized finance, or DeFi, protocol] had an analogous incident a couple of months again the place they gave out extra rewards than supposed,” blockchain safety researcher Mudit Gupta instructed CNBC. “Nearly everybody who acquired the additional rewards refunded the additional.”

What’s completely different right here is that the Alchemix change misplaced simply $4.8 million.

However Gupta stays hopeful.

“This makes me optimistic that individuals will refund most of COMP tokens, as effectively, however you possibly can by no means make certain,” he mentioned.

What went unsuitable

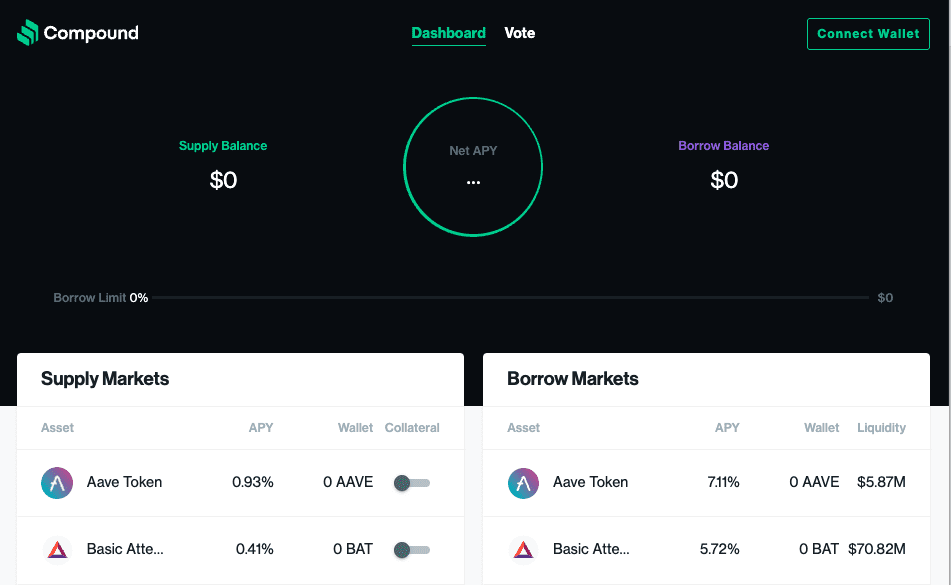

DeFi protocols like Compound are designed to recreate traditional financial systems equivalent to banks and exchanges utilizing blockchains enriched with self-executing sensible contracts.

On Wednesday, Compound rolled out what ought to have been a fairly normal improve. However quickly after implementation, it was clear that one thing had gone significantly unsuitable.

“The brand new Comptroller contract comprises a bug, inflicting some customers to obtain far an excessive amount of COMP,” explained Leshner in a tweet.

“There aren’t any admin controls or neighborhood instruments to disable the COMP distribution; any modifications to the protocol require a 7-day governance course of to make their approach into manufacturing,” he added, indicating that no repair might take impact for seven days.

Gupta, a core developer at decentralized crypto change SushiSwap, said in a tweet that all the episode may very well be blamed on a “one-letter bug” within the code.

Compound made clear that no equipped or borrowed funds had been in danger, however that did little to melt the blow.

Protocol customers en masse started reporting huge windfalls. Quickly after Leshner’s tweet concerning the bug, $29 million price of COMP tokens were claimed in one transaction. One other claimed that they acquired 70 million COMP tokens into their account, or about $20.8 million on the time of their submit.

The listing of COMP token millionaires goes on.

For customers accustomed to offering their crypto to debtors at a set rate of interest, which is usually a single-digit APY, the misguided and sizable rewards had been definitely a pleasant change in tempo.

Leshner made clear, nevertheless, that there’s a cap to the carnage. The Compound chief tweeted that the Comptroller contract handle “comprises a restricted amount of COMP.”

“The impression is bounded, at worst, 280,000 COMP tokens,” Leshner wrote. Gupta instructed CNBC that this whole pool of tokens — price about $90.1 million, as of the time of publication — has already been handed out.

Threats lack enamel

Newly-minted COMP token millionaires now have a couple of choices.

Bitcoin developer Ben Carman factors out that it’s not actually potential for the platform to reclaim the cash.

“They should not be capable of recall the cash with out rolling again the chain,” defined Carman. “They’d must purposefully 51% assault the chain to do away with some blocks.”

So, it’s as much as a consumer’s discretion to resolve subsequent steps.

As a hypothetical, let’s take the account holder who was accidentally gifted $29 million in COMP tokens in error. This consumer might return the funds and maintain onto the $2.9 million “white-hat” tip. However there’s additionally nothing to maintain them from holding their mistaken reward and threat being “doxxed.”

Doxxing somebody means making public what is taken into account personal details about a person, which within the cryptosphere, is tantamount to committing a cardinal sin.

“Doxxing their prospects is concerning the worst factor a crypto firm can do from a PR perspective,” Mati Greenspan, portfolio supervisor and Quantum Economics founder, instructed CNBC.

And it appears unlikely Leshner would pursue that route. He was fast to stroll again his Thursday night tweet, saying that, it “was a bone-headed tweet/strategy.”

After which there’s the risk associated to the mistaken reward being reported to the IRS.

“Section 61 of the IRS code defines revenue very broadly. If you happen to acquired a big sum from this error and resolve to maintain it, that will be thought-about revenue,” defined Shehan Chandrasekera, a CPA and head of tax technique at crypto tax software program firm CoinTracker.io.

Customers who had been mistakenly awarded additional tokens might voluntarily return the funds. In that situation, Chandrasekera says that “technically the recipient is meant to pay revenue tax based mostly available on the market worth of the cash on the time of receipt, but when she or he returns the funds, there is not any cause to report the revenue.”

However Chandrasekera additionally makes clear that nobody has to return the funds. If their reward is reported to the IRS, they might merely be topic to revenue taxes on that quantity.

In order that $29 million COMP token winner stands to take probably the most residence in a situation the place they simply pay as much as Uncle Sam, slightly than pay it again to Compound.

However as Greenspan factors out, how issues play out with this bug is nearly completely inappropriate. “The larger difficulty is – can it occur once more?” he mentioned.

Compound is the world’s fifth-largest DeFi protocol with a whole worth locked of $9.65 billion, in accordance with DeFi Llama, which offers rating and metrics for DeFi protocols.

“The protocol can simply take up a lack of $90 million and quite a lot of it should probably be returned, however the bigger difficulty could be if folks lose confidence within the system’s capacity to perform correctly,” mentioned Greenspan.

[ad_2]

Source