[ad_1]

E-newsletter: Ethical Cash

What you have to know in regards to the fast-expanding world of socially accountable enterprise, sustainable finance and extra. Delivered twice per week.

German firms can not fulfill each worldwide regulators and native securities legal guidelines, Deutsche Financial institution chair Paul Achleitner warned in a speech in Frankfurt on Wednesday.

Germany has a two-tier board system the place the chief board is absolutely in command of the day-to-day enterprise in addition to the company technique. Managers should not take orders from the supervisory board, which is simply entitled to nominate, monitor and advise administration.

“[International] regulators and watchdogs don’t settle for when [a German] chair factors out that’s simply their responsibility to observe the corporate’s management system,” Achleitner stated at a company governance convention. “As a substitute, they count on detailed management measures which might be outdoors the scope of German securities legislation.”

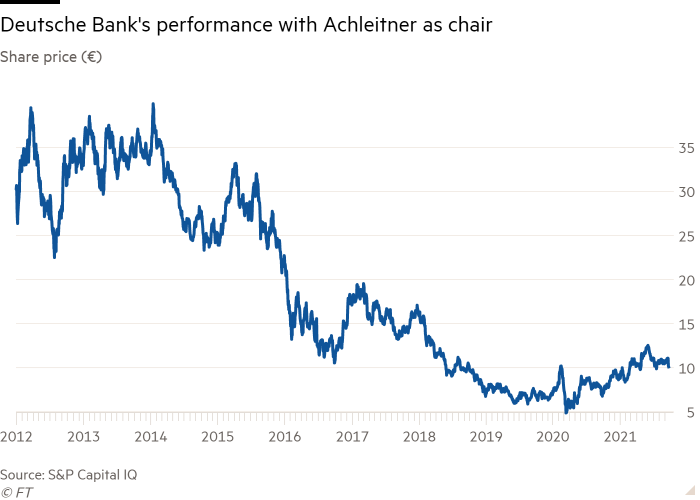

Achleitner has been Deutsche’s chair since 2012 and can depart the lender subsequent Might, when his second five-year time period ends. Deutsche has not but named a successor.

Below his watch, the financial institution’s share worth collapsed by near 70 per cent because it collected losses of €12bn, raised €19.5bn in new capital and paid billions to settle numerous misconduct allegations.

For a lot of the previous 20 years, Deutsche has had a tough relationship with overseas regulators together with the US Federal Reserve, with frequent complaints in regards to the financial institution’s controls.

Deutsche has stabilised since Christian Stitching was made chief government in 2018 and kicked off a radical restructuring. Early this 12 months, the financial institution recorded its highest quarterly profit since 2014, and its share worth is up greater than 45 per cent over the previous 12 months.

In his speech, Achleitner argued that German supervisory boards had turn into way more skilled over the previous decade. Nonetheless, he stated they nonetheless lacked the authorized powers non-executive administrators had on American or British boards and struggled to satisfy the expectations of non-German regulators.

“At the very least within the banking sector, not solely the chair but additionally particular person members of the supervisory board are invited to conversations [by regulators],” Achleitner stated.

“It’s of little assist [in such conversations] to level at German company governance,” he added, arguing that overseas regulators held the supervisory boards accountable for sure points no matter their precise authorized competencies underneath German legislation.

Whereas Achleitner didn’t name for the abolition of Germany’s two-tier board system, he prompt a number of reforms together with that, with the intention to make supervisory boards simpler, they need to be made smaller. At present, they often have 20 members, which makes “productive discussions and fast selections more durable”, he stated.

He additionally known as on the businesses to extend efforts to make supervisory boards extra skilled. “Because the flip of the millennium, we absolutely have seen enhancements with regard to recruitment. We have to construct on them with the intention to meet the rising expectations from buyers and regulators.”

Final week, Stitching needed to apologise after the financial institution printed, and then pulled, a analysis report accusing German monetary regulators and the nation’s outgoing conservative-led authorities of significant failures.

[ad_2]

Source