[ad_1]

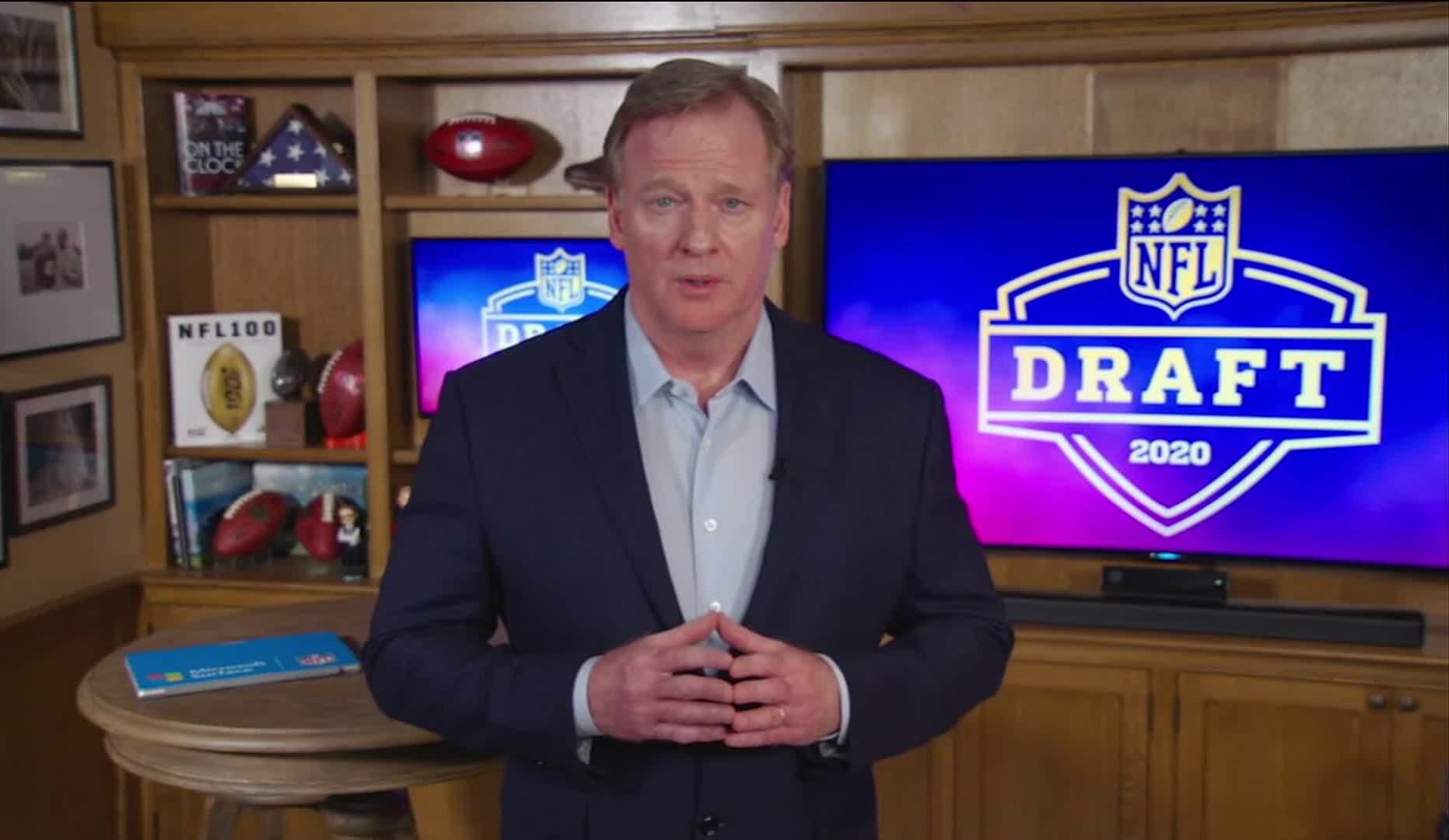

On this nonetheless picture from video offered by the NFL, NFL Commissioner Roger Goodell speaks from his house in Bronxville, New York throughout the first spherical of the 2020 NFL Draft on April 23, 2020. (Picture by NFL by way of Getty Photos)

Picture by NFL by way of Getty Photos

Ultimately month’s Communacopia convention held by Goldman Sachs, Disney CEO Bob Chapek was requested concerning the significance of ESPN and sports activities broadcasting to his firm’s streaming technique. His reply appeared like a throw-away line.

“The primary most-viewed factor yearly tends to be sports activities, one thing like 9 out of 10 of the highest viewership occasions in tv are sporting occasions,” Chapek said in a virtual session on Sept. 21. “Who is aware of what the longer term will carry, nevertheless it’s definitely an vital a part of our shopper choices on the Walt Disney firm.”

Chapek’s generic response concerning the future for certainly one of Disney’s most respected property impressed no follow-up questions or headlines. However Chapek was addressing an existential risk going through the media business, and a problem which will in the future rock the inspiration of his media empire, which incorporates a few of the most respected studios and movie franchises on the planet alongside the dominant community for stay sports activities.

Disney’s huge dilemma for ESPN is whether or not and when to totally embrace a future with out cable.

Broadcast and cable networks nonetheless make billions of {dollars} per yr from the normal TV mannequin. ESPN is a big beneficiary, as a result of media firms earn month-to-month subscriber charges from pay-TV suppliers no matter how many individuals watch their programming. Area of interest channels make just some cents a month per subscriber, whereas sports activities networks cost a number of {dollars}.

Disney makes extra money from cable subscribers than every other firm, and that is solely due to ESPN. ESPN and sister community ESPN2 cost almost $10 per thirty days mixed, in line with analysis agency Kagan, a unit of S&P International Market Intelligence. That’s at least four times more than virtually each different nationwide broadcast or cable community, in line with Kagan.

Disney requires pay-TV suppliers to incorporate ESPN as a part of their hottest cable packages. It is a no-brainer for TV suppliers, who would not dare drop ESPN.

In the meantime, the non-sports world is reducing the wire. Greater than 6 million people ditched pay TV in 2020, in line with analysis agency eMarketer — the best annual whole ever. About 25 million Individuals have dropped linear TV bundles prior to now decade.

That creates a battle inside Disney that is poised to escalate. Disney needs individuals to join its streaming leisure merchandise, Disney+ and Hulu. Wall Road needs this too. Streaming video is a development enterprise. Conventional pay TV is a declining one.

It is also a sensible monetary swap for Chapek. Whereas Disney makes greater than $10 a month per subscriber for sports activities, it makes far much less for leisure networks equivalent to Disney Channel and FX, which draw decrease audiences and do not command excessive promoting charges.

If Disney can get a wire cutter to pay $8 per thirty days for Disney+ and $6 for Hulu, it is an enormous win for the corporate.

The reverse is true for ESPN. Swapping an ESPN subscriber for an ESPN+ buyer, who contributes common income of lower than $5 per thirty days, is a major loss for Disney. ESPN+ is a streaming service with restricted content material.

Bob Iger, left, and Bob Chapek of Disney

Charley Gallay | Getty Photos; Patrick T. Fallon | Bloomberg | Getty Photos

Disney Chairman Bob Iger, who was CEO till final yr, informed buyers when he launched Disney+ that Disney was “all in” on streaming video.

However ESPN is not. ESPN’s technique is to cling to the cable bundle for so long as attainable, understanding it will possibly draw doubtlessly billions of {dollars} from U.S. households which are every paying $120 for the community even when they by no means watch it.

Some analysts have even questioned whether or not Disney ought to spin off ESPN, permitting Chapek to focus extra clearly on streaming. An ex-Disney government, who just lately left the corporate and requested to not be named, stated there’s “strategic misalignment” between the guardian firm and ESPN, and the companies now not belong collectively as a result of Wall Road would not look kindly on declining property. The manager stated having ties to the legacy bundle will crush an organization’s inventory a number of.

ESPN’s match inside Disney

Whether or not or not the match nonetheless make sense, Disney has an enormous monetary incentive, a minimum of within the brief time period, to maintain the wedding going.

At $10 per thirty days, or $120 per yr, multiplied by about 75 million U.S. properties, Disney earns roughly $9 billion yearly in home carriage charges from ESPN and its related networks. Promoting that comes with broadcasting sports activities brings in billions of extra {dollars}.

That money permits ESPN to spend huge on sports activities rights, persevering with a virtuous cycle. Disney agreed to spend $2.7 billion for “Monday Evening Soccer” in a deal that runs all the way in which till 2033. ESPN pays $1.4 billion annually for NBA video games and will likely pay more when these rights will must be renewed after the 2024-25 season. The community owns media rights to each main U.S. sport in some capability.

It additionally permits Disney to pay up for unique streaming content material, bolstering the standard of Disney+ and Hulu as the corporate competes with Netflix and Amazon.

“We’re efficiently navigating the evolution of shopper alternative,” stated Jimmy Pitaro, chairman of ESPN, which is majority-owned and managed by Disney, in an interview with CNBC in April. “We imagine we will be a number of issues on the identical time. As shoppers proceed to gravitate towards direct to shopper, we have now the optionality that we’d like.”

Chairman of Disney Client Merchandise and Interactive Media Jimmy Pitaro.

Steve Zak Pictures | FilmMagic | Getty Photos

ESPN’s position as money machine works properly in the meanwhile. But when 25 million U.S. households ditch cable within the subsequent 4 or 5 years, as some predict, the maths will now not add up, stated LightShed media analyst Wealthy Greenfield.

“If we will 40 to 50 million, the query is, ‘Is there any financial mannequin that justifies the extent of spending that we’re presently at?'” stated Greenfield.

ESPN has to determine easy methods to make up $3 billion in annual misplaced pay-TV subscription income that is coming within the subsequent few years as cord-cutting continues, a decline that Disney executives are anticipating, in line with individuals acquainted with the matter.

Disney’s plan is to incrementally elevate the worth of ESPN+ because it provides extra priceless content material whereas sustaining contractual obligations for unique programming to pay-TV distributors, the individuals stated. An early instance is Eli and Peyton Manning’s different broadcast of “Monday Evening Soccer,” which will air 10 times this season on ESPN2, with some appearances obtainable on ESPN+.

Ought to the variety of pay-TV bundle subscribers drop to a stage properly below 50 million U.S. households, Disney would seemingly take ESPN to shoppers in a extra full streaming bundle, stated two individuals with information of the corporate’s plans. At that time, the economics would flip, as most people paying for linear TV could be sports activities followers. Disney may seemingly make extra from a full-service sports activities streaming service than it will make in a wholesale pay-TV distribution mannequin.

Within the close to time period, promoting ESPN separate from the linear bundle is not possible. Disney has negotiated digital rights flexibility in virtually each main rights renewal prior to now few years. However the firm is presently restricted by its linear pay-TV obligations, which require sure premium programming to remain unique to the cable bundle, in line with individuals acquainted with the matter.

What to cost for streaming ESPN

David Levy, the previous president of WarnerMedia’s Turner Broadcasting, stated that Disney may have loads of leverage with shoppers when the time involves bypass the bundle.

It is a Might 16, 2018, file picture displaying then-Turner Broadcasting President David Levy attending the Turner Networks 2018 Upfront in New York.

Evan Agostini | Invision | AP

Levy, who’s now chairman of knowledge agency Genius Sports, stated he thinks Disney can get 30 million prospects to pay $30 a month for streaming ESPN, or greater than double the fee for the standard Netflix subscription. That might herald $10.8 billion yearly — greater than Disney makes at the moment from pay-TV affiliate income.

“With sports activities, there is a assured built-in viewers,” Levy stated. “It is a lot totally different than leisure. With leisure, each present is hit and miss, and also you at all times should market content material. You by no means know what is going to succeed and what will not. That is why sports activities is the very best content material to spend money on, and will probably be it doesn’t matter what the distribution mannequin is.”

However Levy’s estimate could also be optimistic. A high government at one of many largest U.S. pay-TV operators informed CNBC that about 15% of video subscribers are heavy sports activities viewers. That might equal simply over 11 million U.S. households. Even when ESPN may double that quantity for a streaming app at $30, the service would make lower than the $9 billion ESPN takes in at the moment.

The uncertainty of what number of subscribers pays for sports activities in an à la carte streaming world is not misplaced on the leagues. The NFL inbuilt early out-clauses to its most up-to-date 11-year offers with the networks, in line with individuals acquainted with the matter, permitting the league to bail if the enterprise mannequin stops working. The NFL can finish its settlement after seven years with CBS, NBC and Fox and after eight years with ESPN, stated the individuals, who requested to not be named as a result of the negotiations had been personal.

That is why Disney and different networks with stay sports activities need to hold the linear bundle round till they should let it go. It is troublesome to make up the misplaced income in a dependable approach.

“We imagine strongly that the normal pay TV bundle will stay intact for a very long time,” stated

Sean McManus, chairman of ViacomCBS‘s CBS Sports activities. “I do not assume it ever whittles away to zero. And whereas it is definitely attainable the quantity of subscribers will proceed to say no, I do not assume the decline ever reaches some extent within the coming years that it will not help the present rights offers that we have now, each for NFL soccer and our different sports activities.”

Churn child churn

A streaming-only world would additionally topic ESPN to a problem that it is by no means needed to fear about: Churn.

Individuals who cancel ESPN unsubscribe from the entire linear bundle. Within the direct-to-consumer market, it will be straightforward for soccer fanatics to solely subscribe throughout the few months when video games are performed.

A globe stands on the entrance to the ESPN Vast World of Sports activities advanced in Lake Buena Vista, Fla.

Phelan M. Ebenhack by way of AP

ESPN executives have been enjoying with methods to incentivize annual membership on the present ESPN+ service to scale back month-to-month volatility. A number of instances this yr, ESPN has offered a pay-per-view UFC combat for $69.99 on ESPN+, and on the identical time supplied a full-year membership, that would come with the match, for $89.99, a 35% low cost.

Packaging ESPN+ with Hulu and Disney+ is one other churn buster, because the mixed providing is 33% cheaper than shopping for all three individually.

Nonetheless, a extra full ESPN providing mixed with one other streaming service must price extra, a proposition that may seemingly scare away the non-sports followers, who’re used to paying a lot much less. Disney already packages sports activities in a few of its international streaming companies, equivalent to India’s Disney+ Hotstar and Latin America’s Star+. However the economics internationally aren’t the identical as within the U.S.

“Should you put sports activities into Hulu or Disney+, as an alternative of charging $5 or $7, now you are charging $30?” Greenfield stated. “And you then’re making an attempt to compete in opposition to Netflix at $15. There isn’t a mannequin I see that works. There isn’t any straightforward reply.”

Threats and saviors

Then there are the know-how dangers.

ESPN executives are hesitant about transferring their prized programming to on to shoppers due to rampant password sharing amongst younger customers, in line with individuals acquainted with the matter.

“Watching a pirated stream or sharing a streaming service password looks as if a victimless crime,” stated John Kosner, who led digital media at ESPN from 2003 to 2017 and is now president of media consulting agency Kosner Media. “Nevertheless it actually impacts the enterprise mannequin of sports activities on streaming companies.”

Whether or not youthful audiences even want live sports is one other concern for Disney. Different leisure choices, equivalent to social media, cellular video games and on-demand leisure companies could also be eroding the cultural grip of televised sports activities. Individuals age 13 to 23 are half as seemingly as millennials to observe stay sports activities often and twice as more likely to by no means watch, in line with a 2020 Morning Consult survey.

“The general relevance of sports activities is an open query for the youthful era,” stated Kosner.

One potential mannequin that would save Disney quite a lot of future heartburn is a brand new streaming bundle that successfully replicates pay TV however with extra choices. If that turns into the successful type of distribution, media firms could also be in a well-known place, creating wealth from their most-popular companies even when not everyone seems to be watching them.

Dexter Goei, CEO of cable TV supplier Altice USA, stated in Might that such a product providing may work properly for the sustainability of the media business.

It “would enable us to focus totally on our broadband product” and “be a accomplice for content material on a direct-to-consumer foundation versus a accomplice on a linear foundation,” Goei stated at JPMorgan’s Technology, Media & Communications convention. It “will dramatically enhance the financial developments of our enterprise from a cash-flow standpoint,” he stated.

FanDuel betting cubicles

Supply: FanDuel

The rising reputation of sports activities betting may additionally assist. Betting by cellular app, which is slowly being legalized around the country, boosts viewership, as a result of “in the event you place a guess on a sport, you are more likely to observe that sport,” Levy stated.

Kosner added that augmented actuality gadgets that create new viewing experiences and progressive merchandise like non-fungible tokens (NFTs), that are digital collectibles, even have the potential to lure youthful followers to observe video games.

Add all of it up, and media executives can discover loads of causes to be optimistic regardless of the uncertainty that lies forward for stay sports activities.

“The worth of sports activities continues to be increasingly more vital each single yr,” CBS’s McManus stated. “Advertisers are going to proceed to need to attain the biggest attainable audiences. The way in which to try this is with sports activities. I do not see a cliff coming. Our roadways are clear.”

(Disclosure: Comcast’s NBCUniversal is the guardian firm of CNBC.)

WATCH: ESPN chairman Jimmy Pitaro on ESPN+ and new NFL deal

[ad_2]

Source