[ad_1]

That is the primary a part of an FT collection analysing how the electrical car market has quickly shifted from first gear to fifth

At first of the 12 months, executives at electric carmaker Polestar drew up bold gross sales plans for the UK. Inside weeks, they needed to tear them up.

Demand was rising so rapidly that the brand new targets had been a 3rd greater. At this time the Volvo-backed firm runs round 1,000 check drives a month within the UK alone. Every week, new areas are booked up inside an hour of changing into obtainable.

Till 4 years in the past, Polestar specialised in tuning excessive efficiency combustion engines: now it has been remodeled into one of many corporations attempting to faucet the booming demand for battery automobiles. “This isn’t the area of interest promote it was two or three years in the past,” says Polestar’s UK boss Jonathan Goodman.

This extraordinary surge in demand is being felt proper internationally, from Shanghai to Stuttgart, Tokyo to Toronto, and from new manufacturers to the established giants of the trade.

FT collection: the EV revolution

Options on this collection will embrace:

Half 1 Why the revolution is lastly right here

Half 2 How inexperienced is your EV?

Half 3 Will People ever purchase electrical automobiles?

Half 4 Batteries and China’s bid to dominate

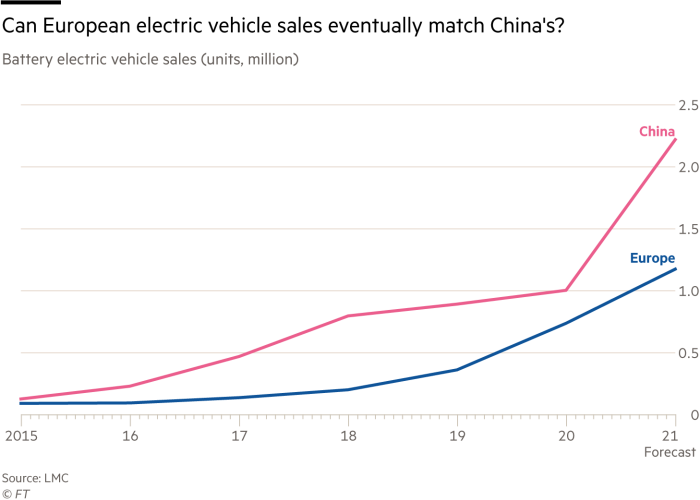

It’s significantly acute in Europe. One in 12 automobiles offered throughout the continent between April and June this 12 months ran on batteries alone. If hybrid fashions that use each an engine and a battery are counted, this rises to at least one in three. Gross sales of electrical automobiles in Europe have jumped from 198,000 in 2018 to an anticipated 1.17m this 12 months.

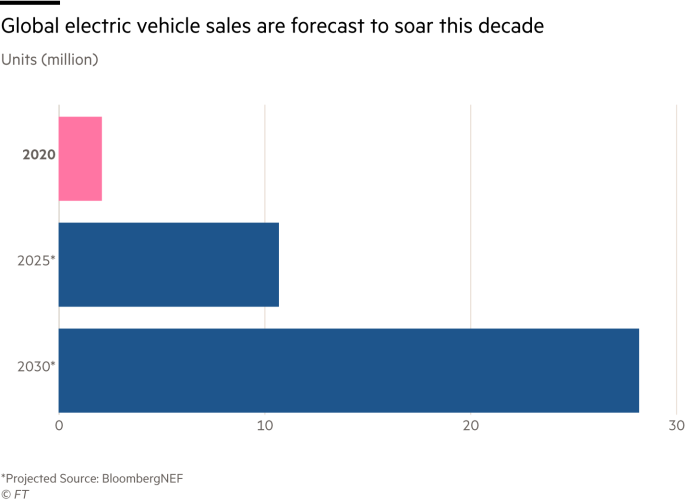

Electrical automobiles nonetheless solely make up about 1 per cent of the worldwide fleet of passenger automobiles, however gross sales are taking off quickly. Inside 4 years, one quarter of latest automobiles purchased in China and practically 40 per cent of these bought in Germany are anticipated to be electrical, in keeping with BloombergNEF. International gross sales of EVs are forecast to achieve 10.7m by 2025 after which 28.2m by 2030.

Till not too long ago for a lot of drivers, electric vehicles appeared a topic for the long run: however now it’s commonplace to think about their subsequent automotive being electrical.

Once in a while, a slow-burning shift in the way in which the world works instantly begins to collect tempo at a speedy price. That’s what is going on with electrical automobiles. In a comparatively brief area of time, the transformation within the auto trade has gone from first gear to fifth.

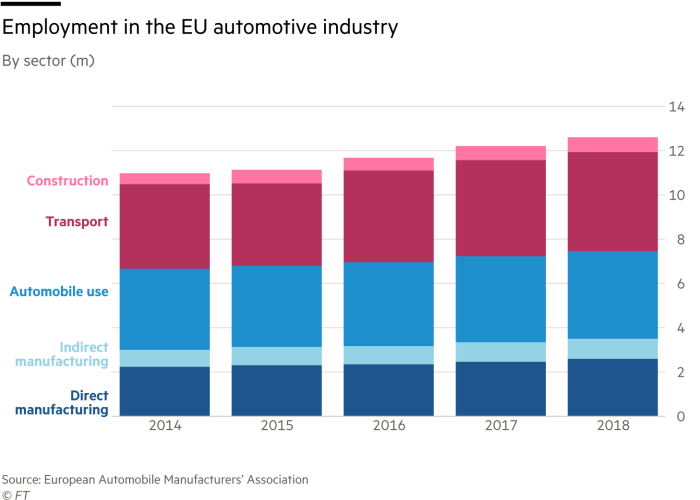

Given the significance of auto manufacturing to many economies, the shake-up that’s beginning to convulse the trade has huge implications for jobs, city growth and even geopolitics.

Andy Palmer, the previous Nissan govt who helped launch the trade’s first mass produced electrical automotive the Nissan Leaf in 2010, believes the shift is “like transferring from the horse to the automotive”.

“It’s that seismic, it adjustments every part, and to such an extent that any gamers that don’t pivot quick sufficient, that don’t make investments, are unlikely to outlive into the long run,” says Palmer, who’s now CEO of electrical bus firm Change Mobility.

A lot of the eye on electrical automobiles has centered on the hanging success of Tesla or the aggressive ambitions of a bunch of Chinese language corporations. However the different necessary shift over the previous 12 months or two has been the response of the established automakers.

Lots of the world’s greatest international manufacturers, starting from Ford with its F150 Lightning truck to VW and its ID vary, are actually staking their future on EVs. At September’s Munich Motor Present, the primary main European exhibition in two years due to the pandemic, there have been virtually no new petrol fashions debuted.

The electrical and linked automotive trade has attracted greater than $100bn in funding for the reason that starting of 2020, in keeping with McKinsey. That’s only the start. Carmakers have introduced a complete of $330bn of funding into electrical and battery expertise over the following 5 years, in keeping with calculations from consultancy AlixPartners, a sum that has risen 40 per cent over the previous 12 months.

“Is that this an inflection level?” asks Andrew Bergbaum, a managing director at AlixPartners. “I believe the reply must be sure.”

A number of producers have taken beforehand unthinkable motion: getting ready to section out the interior combustion engine altogether.

Earlier this 12 months the German firm credited with inventing the motor automotive set out one of many industry’s most ambitious timetables. From the center of this decade the techniques used to construct all Mercedes-Benz automobiles will change over to producing electrical fashions.

“We’re on a really accelerated path in comparison with what we thought even a couple of years in the past,” says Ola Kallenius, chief govt of Mercedes proprietor Daimler.

Push for cleaner air

Why is that this taking place now? A part of the reason lies in politics. Whereas carmakers have talked for years about launching electrical fashions, political strain has spurred them to make the primary actual concerted effort to promote them in any vital numbers.

Emissions guidelines throughout Europe led to the primary huge wave of electrical automotive gross sales final 12 months. Some 734,000 battery fashions had been offered throughout the continent in 2020 regardless of pandemic lockdowns, in keeping with LMC Automotive, double 2019’s degree and greater than the earlier three years mixed.

The regulatory screws are tightening. In lower than a month governments from internationally will congregate in Glasgow for the COP26 climate summit, many anticipated to be armed with eye-catching pledges to cut back their emissions. Formidable plans to develop the usage of electrical automobiles are probably the most apparent methods to satisfy these targets.

The UK has already introduced plans to finish the sale of petrol and diesel automobiles altogether by 2035, with Norway pursuing a extra aggressive phaseout date of 2025. The EU is proposing its personal 2035 de facto ban.

These commitments are anticipated to come back alongside spending pledges to assist drive, amongst different issues, set up of the charging factors wanted to persuade customers to modify to electrical en masse.

“Governments are placing their cash the place their mouth is,” says Kallenius. “The most important job the place authorities and trade can work hand in hand is infrastructure funding.”

It isn’t solely nationwide governments which can be squeezing down on emissions.

A number of metropolis authorities are pricing older automobiles off the roads with clear air zones, pushing motorists on the city fringes to shift to cleaner automobiles, lots of them turning to electrical fashions.

London’s personal “Extremely Low Emission Zone”, which penalises motorists with older automobiles, expands this month to incorporate its round ring-roads, an space that impacts 2.6m automobiles. Paris, Brussels and Amsterdam are amongst cities with comparable schemes, whereas restrictions on older diesel fashions are in place in scores of German metropolis centres.

Engaging fashions

The most important cause for the EV revolution out there is the availability of automobiles. The automobiles are actually able to attraction to all kinds of purchaser.

Till not too long ago, the shortage of viable “product” was the primary barrier to customers leaping into an electrical automotive. However automakers have been working flat-out to supply enticing battery fashions.

After years of hyping idea fashions at motor exhibits, carmakers now provide a set of electrical automobiles for purchasers to purchase, from small metropolis automobiles to bigger household wagons, with dozens extra deliberate within the subsequent few years.

Whereas many are nonetheless dearer than petrol automobiles, they boast considerably decrease working prices — much more in order international petrol costs rise — whereas most governments nonetheless provide beneficiant buy incentives.

There are round 330 pure electrical or hybrid fashions that mix a battery and conventional engine on sale right now, in keeping with calculations from AlixPartners, in contrast with simply 86 5 years in the past. That quantity will balloon additional to greater than 500 by 2025, amid a flurry of latest releases.

When the pandemic hit final 12 months, most carmakers reined in spending on all however essentially the most important initiatives. Combustion engine developments had been halted, however spending on electrical expertise really elevated.

“Covid was really among the finest helps the trade has had in years, as a result of it pressured them to be disciplined,” says Philippe Houchois, an automotive analyst at Jefferies.

Even for skilled executives, the pace of the uptake has been stunning. When former Renault chief Thierry Bolloré took the helm at Jaguar Land Rover final September, he started drawing up electrification plans that on the time barely existed. Within the six months it took to finalise the technique, the trade witnessed such an “acceleration” that the early objectives had been scrapped for extra bold targets.

“My staff got here again to me and mentioned may we go quicker,” Bolloré says.

But regardless of the joy, there are pockets of prudence amid the biggest carmakers. Shifting too quick dangers alienating present clients who’re unable or unwilling to shift over, some warn.

“Should you say that fifty per cent of the market in Europe will probably be pure electrical in 2030, there may be nonetheless the opposite 50 per cent, and for those who say you’ll not serve [this 50 per cent] you might be setting your self on a course to shrink,” says BMW’s chief govt Oliver Zipse.

The German carmaker has vowed to launch a battery mannequin in each car class by 2023, however has additionally positioned enormous inventory in hybrid fashions that may drive for a part of the journey on battery energy, earlier than participating their conventional engines when exterior of metropolis limits.

And whereas gross sales of EVs are booming in each Europe and China, each markets nonetheless rely closely on subsidies.

“We’re nonetheless bribing clients closely to purchase EVs in Europe, and the bribing is extra average in China,” says Houchois.

Pancake manufacturing

Such a speedy transformation is an invite for disruption. Electrical automobiles, that are less complicated to design and manufacture than fashions primarily based on the interior combustion engine, have lowered the boundaries to entry right into a once-impregnable trade.

The massive query for the established carmakers is whether or not they can efficiently carve out a future towards the dual threats of start-ups — that vary from Tesla to way more latest newcomers — and the massive variety of Chinese language rivals that are determined to seize market share.

Though Tesla has gone from energy to energy over the previous two years, the latest indicators for the carmakers have been constructive.

For a begin, they’ve made speedy technological advances. Early electrical automobiles from the established stables had restricted ranges, and poor charging speeds. The launch of the Tesla Mannequin S in 2012, with a claimed vary of 260 miles between fees, set the trade commonplace, and has solely not too long ago been matched by the newest releases from Jaguar and Audi.

However the newer fashions from massive gamers are way more aggressive on pricing, vary and efficiency.

“The fact is a modern-day electrical automotive is a bloody good automotive to drive,” says Polestar’s Goodman. “When [former Renault and Nissan boss] Carlos Ghosn mentioned electrical automobiles had been the long run 10 years in the past he was fallacious. However they’re right now.”

Early teething issues, equivalent to heavy delays to the VW ID3 — its first devoted electrical automotive — due to software program faults are prone to be ironed out in future fashions as carmakers turn into extra used to producing the brand new techniques.

“There’s a joke within the trade that EVs are like pancakes; the primary one shouldn’t be good, the second is best and the third is true,” says Houchois.

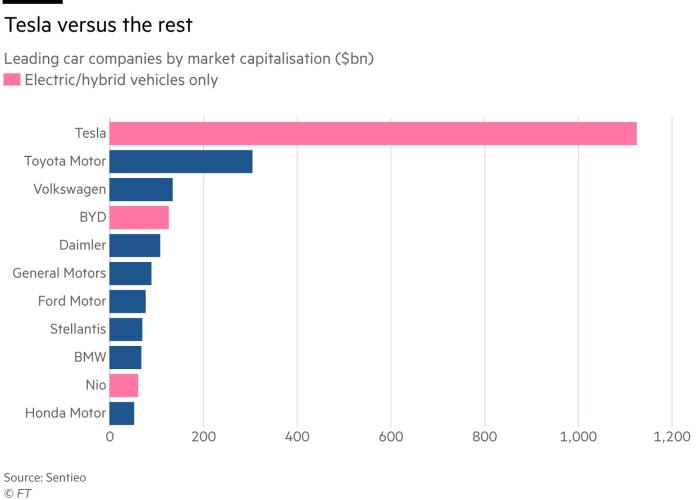

Nonetheless, some carmakers really feel they’re getting into this competitors with one hand tied behind their backs. Pure-play electrical corporations have been in a position to elevate cash or float at huge valuations, whereas established producers commerce at dismally depressed earnings multiples.

Only one instance: China’s NIO, a start-up nonetheless deeply within the crimson, is valued at virtually twice the worth of Ferrari, the trade’s totemic profit-generator.

This 12 months has seen a flurry of listings. Britain’s Arrival, a van group but to construct a single car, floated at $13.6bn by means of a reverse merger, whereas untested US electric pick-up truckmaker Rivian is looking for a roughly $80bn valuation when it lists later this 12 months.

However the outdated empire has begun to strike again. Polestar, the brand new electrical model spun out of Volvo, will probably be valued at $20bn when it floats by means of a reverse merger, exhibiting there may be hope for legacy auto teams to faucet into market pleasure by carving out new manufacturers.

This presents a possibility for companies equivalent to JLR, which plans to make the Jaguar brand fully electric by 2025.

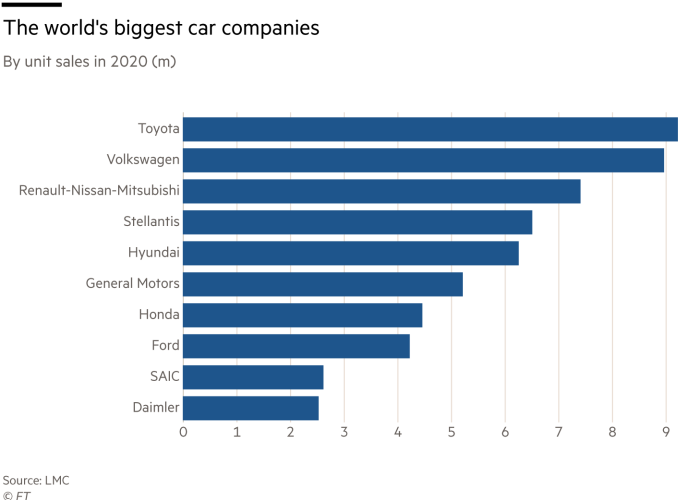

Herbert Diess, chief govt of VW Group, says he’s much less involved about new entrants, which nonetheless must grapple with the complexities of mass manufacturing and protecting their newly received clients pleased with functioning service centres.

“It’s straightforward to indicate a examine of an electrical automotive in a [motor] present, however to construct up a plant most of them will probably be slower than us,” he says.

The primary plant from Chinese language start-up NIO was so beset by delays that the corporate filed IPO paperwork having shipped simply 400 automobiles.

Even Tesla, which Diess has praised prior to now, has taken 15 years to achieve its present place occupying round 1 per cent of worldwide automotive gross sales, he provides.

For the established carmakers, the biggest menace would possibly come not from start-ups, however from China.

Whereas China’s homegrown gamers equivalent to SAIC and First Auto Works didn’t compete with worldwide rivals within the engine period, the shift to electrical automobiles provide an opportunity to dominate a subject historically held by Germany, Japan and the US.

A plethora of electrical companies, nicely funded by native governments or main carmakers and sometimes staffed by former European engineers, have entered the market.

The primary Chinese language-made electrical automobiles have already crept into European showrooms, from the SAIC-owned MG model and new teams equivalent to NIO and Aiways.

However earlier than lengthy these newcomers must compete with manufacturers which can be already acquainted to clients as established carmakers roll out their new fashions. Final 12 months, 9 out of 10 automobiles leaving Volvo’s Studying dealership west of London had been solely petrol or diesel pushed. At this time, virtually half have both hybrid or full electrical expertise.

“The planets are aligning,” says John O’Hanlon, boss of Waylands Automotive, which runs the Berkshire web site. “What we’ve seen within the final six months is the growing consciousness of shoppers. Individuals are genuinely coming in and asking whether or not this could work for me. And lots of of them are driving away, considering they may reside with one.”

Down the street within the village of Little Chalfont, the VW dealership has been flooded with orders for ID3 automobiles by native motorists whose mileage is proscribed and who can cost their new fashions of their driveways.

“The uptake is big, individuals have embraced it,” says Jonathan Smith, boss of dealergroup Citygate, which owns the positioning. “The tempo is phenomenal, as soon as there’s the infrastructure to help it there will probably be no stopping it.”

Observe @FTclimate on Instagram

Local weather Capital

The place local weather change meets enterprise, markets and politics. Explore the FT’s coverage here.

Are you interested in the FT’s environmental sustainability commitments? Find out more about our science-based targets here

[ad_2]

Source