[ad_1]

This text is an on-site model of our Unhedged e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each weekday

Welcome again. It appears I used to be sensible to not write concerning the market implications of the debt restrict kerfuffle; a truce is about to place the entire mess off till the top of the 12 months. Like everybody else, I watch the costs of US credit score default swaps rise as these dumb arguments escalate, however all the time assume it’s in the end SFSN (sound and fury signifying nothing). Possibly at some point I shall be fallacious. E-mail me: robert.armstrong@ft.com

Vitality costs, inflation, and progress

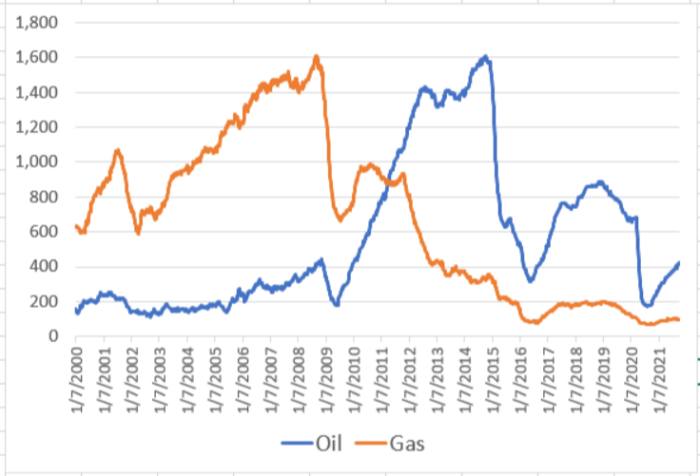

Right here’s a chart:

That’s varied world fossil gas costs, rebased to 100 six months in the past. The one drawback with placing all of them collectively signifies that the completely bonkers rise within the costs of pure gasoline within the UK and liquid pure gasoline in Asia overshadow the merely staggering doubling of Chinese language coal and US pure gasoline costs. The objectively spectacular 30 per cent rise in Brent crude costs appears positively limp by comparability.

The massive query concerning the run-up in world power prices is how lengthy it is going to final. That’s, are we taking a look at a short lived provide/demand imbalance — a a lot bigger model of, say, the wild rise in US lumber costs, which peaked at 4 instances regular ranges in Could solely to retrace their steps fully by August? Or is that this one thing extra lasting?

Relying on the reply to that query, there are two subsidiary questions: how a lot will these worth strikes spur inflation extra broadly? And the way massive a drag on world progress will they be?

On the large query, a part of the reply is that fossil gas provide has been falling for years, due to decrease funding in extraction. Right here for instance is a chart of capital expenditure, each in absolute phrases and as a proportion of gross sales, by power firms within the S&P International 1200 power index (information from Capital IQ):

If funding from privately held firms have been included, the image may look a bit completely different, however I believe the pattern can be the identical. A part of that is all the way down to efforts to scale back carbon emissions. That is most blatant within the case of coal, however governments and traders are discouraging new power initiatives typically, and power firms are listening.

However decarbonisation is simply a part of the provision story. One other a part of it’s that the administration of power firms, notably at US power producers, are listening to shareholders, and shareholders need capital returned to them, quite than invested in new initiatives. That is from a exceptional latest FT interview with Scott Sheffield, who runs Pioneer Pure Assets, one of many largest US shale oil producers:

Everyone [in the industry is] going to be disciplined, regardless whether or not it’s $75 Brent, $80 Brent, or $100 Brent. All of the shareholders that I’ve talked to mentioned that if anyone goes again to progress, they may punish these firms . . .

There’s no progress traders investing in US majors or US shale. Now it’s dividend funds. So we will’t simply whipsaw the folks that purchase our shares . . .

I’m getting as a lot in dividends off of my inventory subsequent 12 months as I’m in my complete compensation. That’s a complete change in mindset.

The mindset change reveals. That is the variety of lively oil and gasoline rigs within the US since 2000 (Baker Hughes information):

If costs improve extra, traders and operators might have a change of coronary heart about new oil and gasoline investments. And there could also be a change in sentiment already. I spoke to Andrew Gillick, a strategist on the power consultancy Enverus, and he informed me that whereas traders are centered on capital returns, investor curiosity in oil and gasoline is rising and power fund managers are elevating cash once more:

Speaking to grease and gasoline funds a 12 months in the past, they have been coping with redemptions. Now, these which can be nonetheless in a position to make investments are excited concerning the alternative each as a hedge towards inflation and a hedge towards an extended power transition — and since they see operators decide to self-discipline and capital returns.

However an enormous shift in spending will take time. It takes six months or so to get a brand new rig up and operating. The availability strain on fossil fuels is not going to abate rapidly.

Will a better plateau in power costs feed inflation in different areas? Actually, the latest hop in 10-year inflation break-even charges (from 2.28 per cent two weeks in the past to 2.45 per cent now) has been extensively attributed to power costs. However the relationship will not be determinate. Contemplate this chart of break-evens and Brent crude:

As Oliver Jones of Capital Economics factors out, the early 2000s present that whereas the connection is shut, it isn’t mounted. At the moment, Brent shot up and inflation break-evens shrugged. Right here’s Jones:

Again then, the mixing of China’s booming economic system with the remainder of the world helped drive the commodities “supercycles”, but additionally put downward strain on the costs of manufactured items globally. In the meantime, there was solely restricted inflation generated inside the US. The Fed hiked charges by 425bp in two years, and monetary coverage was not notably free. In distinction, China’s economic system as we speak is slowing, and decoupling from the US. On the similar time, we predict that domestically generated worth pressures within the US will stay stronger within the coming years than within the 2000s or 2010s, reflecting each the results of the pandemic on the labour market and policymakers’ modified priorities.

Consequently, Jones thinks inflation could choose up extra whilst power costs fall again as provide and demand rebalance.

Lastly, how a lot may a sustained bounce in power costs drag on the economic system? Effectively, have a look at the US gasoline worth and US client spending on power (hat tip to @francesdonald):

Now that’s a determinate relationship. Right here is how Ian Shepherdson, of Pantheon Macroeconomics, sees the maths:

Folks at the moment spend about $7bn per 30 days on utility power companies and $31bn per 30 days on gasoline, which collectively account for 7.3 per cent of the CPI. Whole retail gross sales ex-gasoline stood at $569bn in August, so an incremental 5 per cent improve in power costs would depress different retail gross sales by as much as 0.3 per cent, by forcing folks to divert spending from different items and companies. Or no less than, that’s what would occur underneath regular circumstances.

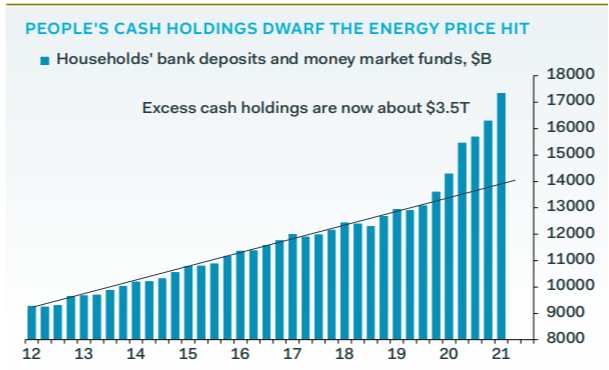

However these aren’t regular circumstances. People saved loads of money within the pandemic, which Shepherdson graphs like this:

So possibly the surplus money will merely sop up the additional spending on gasoline, and non-gas client spending shall be unaffected. The issue, although, is that the surplus money is generally within the pockets of the wealthy, who have a tendency to save lots of quite than spend incremental wealth. Center and dealing class People in contrast could really feel the pinch from costs on the pump and in the reduction of elsewhere. This chart from the Fed Guy blog reveals how the wealth amassed in the course of the pandemic was distributed:

These People who’ve all the time anxious about gasoline costs are going to be notably anxious now, and that may most likely matter to progress.

One good learn

Talking of oil, this is horrifying.

[ad_2]

Source