[ad_1]

A dramatic video filmed within the southwestern metropolis of Kunming in August hints on the scale of China’s property bubble. Onlookers might be heard screaming in awe as 15 high-rise condo blocks are demolished by 85,000 managed explosions in lower than a minute.

The unfinished buildings, which fashioned a fancy referred to as Sunshine Metropolis II, had stood empty since 2013 after one developer ran out of cash and one other discovered defects within the development work. “This city scar that stood for almost 10 years has eventually taken a key step towards restoration,” stated an article within the official Kunming Every day after the demolition.

Such “city scars” are frequent throughout China, the place Evergrande — the world’s most closely indebted property firm — is struggling a liquidity crunch that could prove terminal. The disaster on the firm, which as not too long ago as two years in the past ranked because the world’s most precious property inventory, highlights each the pace at which company fortunes can unravel and the deep flaws in China’s growth model.

Evergrande, for the entire excessive drama of its meltdown, is merely the symptom of a a lot greater drawback. China’s huge actual property sector, which contributes 29 per cent of the nation’s gross home product, is so overbuilt that it threatens to relinquish its longstanding role as a first-rate driver of Chinese language financial progress and, as an alternative, grow to be a drag on it.

There’s sufficient empty property in China to deal with over 90m individuals, says Logan Wright, a Hong Kong-based director at Rhodium Group, a consultancy. To place that into perspective: there are 5 G7 international locations — France, Germany, Italy, the UK and Canada — who might match their total populations into these empty Chinese language flats with room to spare.

“We estimate present however unsold housing stock is within the vary of 3bn sq. metres, which is sufficient to home 30m households, conservatively,” Wright says, explaining his calculations. The common measurement of a family in China is simply over three individuals, giving sufficient house for over 90m individuals.

Oversupply has been an issue for a number of years. What modified is that final yr China determined the difficulty had grow to be so persistent that it wanted to firmly deal with it. President Xi Jinping had additionally run out of endurance with the excesses of the property sector, say observers, and Beijing formulated “three red lines” to cut back debt ranges within the sector. Evergrande is proving to be the primary massive sufferer.

As the corporate falters, its undoing raises a elementary query for the world’s second-largest financial system: has China’s property-driven growth model — the worldwide financial system’s strongest locomotive — run out of street?

Sure, says Leland Miller, chief government of China Beige E book, a consultancy which analyses the financial system by way of proprietary knowledge. “The management in Beijing has been extra frightened about Chinese language progress than anybody within the west.

“There’s a recognition that the previous construct, construct, construct playbook doesn’t work any extra and that it’s truly getting harmful. The management now seems to be pondering that it may’t wait any longer to vary the expansion mannequin,” Miller says.

Ting Lu, chief China economist at funding financial institution Nomura, says he doesn’t anticipate Evergrande’s woes to set off an financial collapse. However he believes Beijing’s makes an attempt to transition from one progress mannequin to a different might considerably depress annual progress in coming years.

“There’s unlikely to be a sudden cease,” Lu says. “However I feel China’s potential [annual] progress fee will drop to 4 per cent and even decrease between 2025 and 2030.”

Wright says the property sector is changing into a menace to monetary, financial and social stability — it has already sparked protests in a number of cities. “It is vitally tough to offer a compelling narrative that China’s potential progress will exceed 4 per cent within the subsequent decade,” Wright provides.

Miller echoes that sentiment. “We’re set for a roller-coaster journey in coverage and in financial progress,” he says “I might not be stunned if a decade from now GDP progress was 1 or 2 per cent.”

If such projections show right, the Chinese language progress “miracle” is in peril. Within the decade from 2000 to 2009, China’s GDP progress averaged 10.4 per cent a yr. This stellar efficiency abated in the course of the decade from 2010 to 2019, however annual GDP nonetheless grew by a median of seven.68 per cent.

Any fall in progress could be swiftly felt worldwide. China has lengthy been the largest engine of world prosperity, contributing 28 per cent of GDP worldwide from 2013 to 2018 — greater than twice the share of the US — based on a examine by the IMF.

“Even when China avoids a pointy and sudden disaster,” says Jonas Goltermann at Capital Economics, a analysis agency, “its medium-term prospects are a lot worse than typically acknowledged.”

Crossing Xi’s ‘purple traces’

The dangers that spring from the Evergrande saga embody each monetary contagion — particularly within the offshore US greenback bond market — and the prospect {that a} flagging property sector will strike at a few of the important organs of the Chinese language financial system, probably miserable GDP progress for years to return.

The fallout from the disaster is already appreciable. Evergrande’s plummeting share worth has slashed the corporate’s market capitalisation from $320bn final yr to about $3.7bn now. And considerations round its attainable collapse triggered a world markets sell-off this week. Some 80,000 individuals in China who maintain about $40bn within the firm’s wealth administration merchandise are ready nervously to see whether or not Evergrande will honour fee obligations. Offshore bondholders are bracing for a default, maybe as early as Thursday, with one bond as a consequence of pay curiosity buying and selling at about 30 per cent of its face worth.

However probably longer lasting impacts derive from the broader fall in China’s property market. It’s clear that the true property sector is in a tailspin, with gross sales in 52 giant cities down 16 per cent within the first half of September yr on yr, extending a 20 per cent decline in August, based on official knowledge.

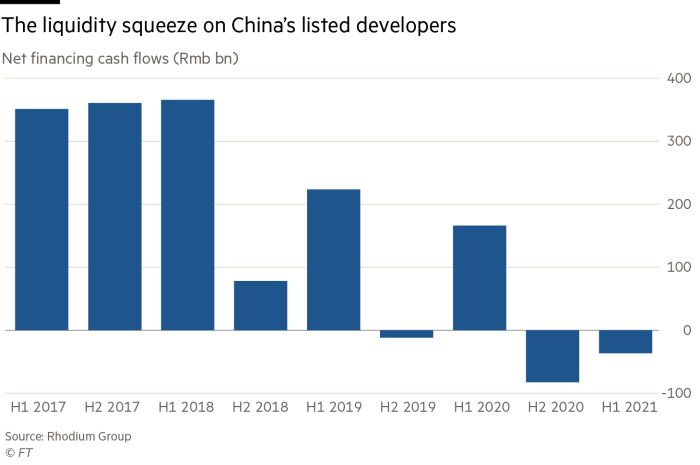

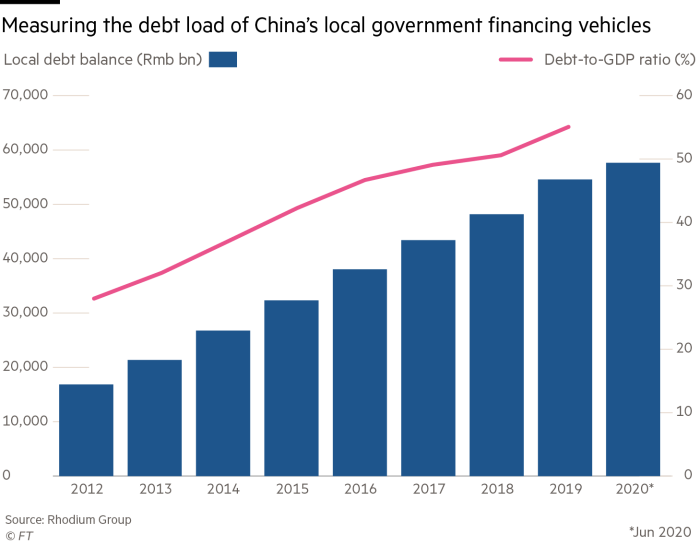

An much more consequential pattern for China’s political financial system is the collapse in land gross sales by native governments, which fell 90 per cent yr on yr within the first 12 days of September, official figures present. Such land gross sales generate about one-third of native authorities revenues, which in flip are used to assist pay the principal and curiosity on some $8.4tn in debt issued by a number of thousand native authorities financing autos. LGFVs act as an typically unseen dynamo for the broader financial system; they increase capital by way of bond issuance that’s then used to fund huge infrastructure tasks.

“We anticipate land gross sales income to get a lot worse,” says Nomura’s Lu.

This dwindling capability of native governments to boost finance to spend on infrastructure has the potential to depress Chinese language progress significantly. Fastened asset funding, which final yr totalled Rmb51.9tn ($8tn), constitutes 43 per cent of GDP.

Misery is already evident in an offshore US greenback bond market, the place some $221bn in debt raised by a number of hundred Chinese language property builders is buying and selling. Massive chunks of the market are presently priced for default. “A full 16 per cent of the market is buying and selling at yields of over 30 per cent and 11 per cent of the market is buying and selling at yields of over 50 per cent,” Wright says.

Yields of over 50 per cent recommend defaults are probably, he provides.

In the end, the destiny of such bonds, and nearly all different offshoots from the malaise in Chinese language property, is determined by Beijing. The Chinese language state owns nearly the entire nation’s giant monetary establishments, that means that if Beijing orders them to bail out Evergrande or different distressed property firms, they may observe orders.

In some abroad markets the concept that Evergrande’s misery could presage a “Lehman moment” — recalling the chaos that adopted the collapse of US funding financial institution Lehman Brothers 13 years in the past — has gained traction. However given Beijing’s affect and vested pursuits, the analogy doesn’t simply match.

“Until China’s regulators critically mismanage the state of affairs, a systemic disaster within the nation’s monetary sector shouldn’t be on the playing cards,” says He Wei, an analyst at Gavekal, a analysis firm.

Certainly, the principle explanation for Evergrande’s disaster and the downturn within the broader property sector is Beijing itself. The “three purple traces” that the Xi authorities introduced final yr stipulate that builders should maintain debt ranges inside affordable bounds.

Particularly, it says that the ratio of liabilities to belongings have to be beneath 70 per cent, the ratio of web debt to fairness have to be beneath 100 per cent and the ratio of money to short-term debt have to be at the very least 100 per cent. In June, Evergrande was failing on all three metrics and was subsequently forbidden from raising additional debt — triggering its current crisis.

‘Widespread prosperity’

Whether it is true that Beijing is the principle explanation for Evergrande’s predicament, then it stands to cause that it may finish the present market meltdown by taking its foot off the property sector’s throat.

However deep structural forces within the financial system have satisfied China’s policymakers that property can not be a dependable dynamo for sustainable financial progress, analysts say. This isn’t solely due to Xi’s well-known phrase that “homes are for dwelling in, not for hypothesis,” made in a 2017 speech.

For one factor, the demand image has modified completely from when Beijing pushed by way of free market reforms within the late Nineteen Nineties that touched off the largest actual property growth in human historical past.

China’s inhabitants is hardly rising. In 2020, solely 12m infants have been born, down from 14.65m a yr earlier in a rustic of 1.4bn. The pattern could nicely grow to be extra pronounced over the subsequent decade because the variety of girls of peak childbearing age — between 22 to 35 — is because of fall by greater than 30 per cent.

Some specialists are predicting that the delivery fee might drop beneath 10m a yr, throwing China’s inhabitants into absolute decline and additional dampening demand for property.

Houze Track, an analyst at Chicago-based think-tank MacroPolo, says the state of affairs is exacerbated by the phenomenon of “shrinking cities”. After round three many years throughout which a whole bunch of thousands and thousands of individuals left their rural villages to settle in cities, the largest migration in human historical past has now dwindled to a trickle.

About three quarters of the cities in China are in inhabitants decline, says Track. “A decade from now, even assuming that some individuals will depart for progress cities, greater than 600m Chinese language residents will nonetheless reside in shrinking cities.”

China is confronted with a dangerous transition. It’s beginning to shift its progress mannequin away from an over-reliance on real estate to extra most well-liked engines of progress reminiscent of high-tech manufacturing and the deployment of inexperienced applied sciences, analysts say.

Right here once more, the impetus comes from Xi. An inventory of eight priorities launched following an financial planning assembly in late 2020 not solely denounced the “disorderly growth of capital” — understood to have been code for hypothesis in property — it additionally advocated technological innovation and the pursuit of carbon neutrality.

Such a transition could take a number of years to realize, analysts say. However it’s clear from Xi’s current exhortations on the necessity for China to observe “frequent prosperity” that he’s critical. The propensity of actual property to leapfrog in worth in sought-after areas whereas remaining undercooked in low-rent districts has been blamed for widening the inequality hole between wealthy and poor.

“The slogan of ‘frequent prosperity’ is a story change that paves the best way for a shift within the progress mannequin,” says Miller. “It clarifies {that a} drop in GDP progress shouldn’t be a failure for the Chinese language Communist social gathering.”

But, unusual individuals throughout China are struggling the ache of the nation’s property market meltdown. Xu, 36, who requested to not be totally recognized, lives within the central metropolis of Xinyang and works as a secretary at an area manufacturing unit. Her mom purchased a high-yield funding product from Evergrande to assist cowl the medical payments for her late-stage lung most cancers.

However the promised 7.5 per cent returns from the funding, which value Rmb200,000, haven’t materialised. As a substitute, Evergrande is refusing to pay out because it conserves money to stave off probably large defaults.

“My dad and mom have put all they’ve into Evergrande,” says Xu. “That is not simply an financial challenge,” she provides, “that is completely an enormous social challenge. There shall be critical penalties if the difficulty doesn’t get correctly solved.

“If my mom’s well being state of affairs deteriorates due to this,” provides Xu, “I’m going to struggle Evergrande day-after-day.”

Further reporting by Thomas Hale in Hong Kong

[ad_2]

Source