[ad_1]

Worldwide bond gross sales by Chinese language builders have all however halted because the disaster at China Evergrande stokes fears of defaults throughout the nation’s property sector, throttling an important driver of Asia’s high-yield debt market.

Only one developer has managed to faucet abroad bond traders since Evergrande, the world’s most indebted actual property group, missed an $83.5m curiosity fee final month, rattling international markets.

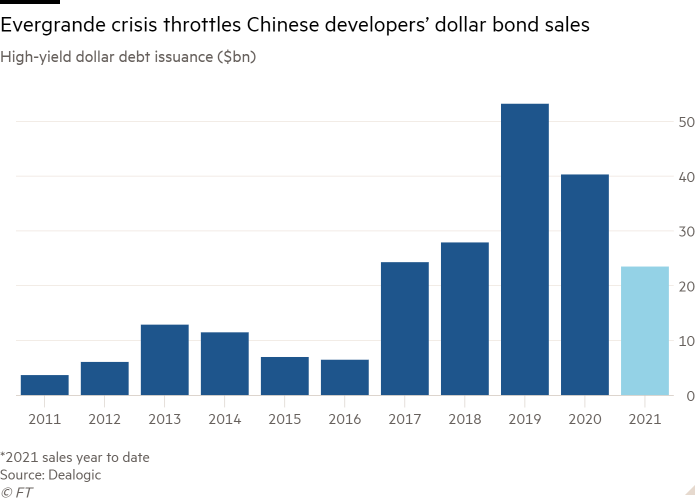

The $102m bond sale by Helenbergh China Holdings this month has achieved little to deal with huge funding shortfalls amongst closely leveraged property teams. Issuance of high-yield greenback debt is down 28 per cent from a yr in the past, based on knowledge from Dealogic.

Bankers and traders mentioned situations have been doubtless solely to worsen with out intervention from Beijing.

“The market actually has turned fairly gloomy,” mentioned a senior debt capital markets banker at one European financial institution, who estimated {that a} third of the roughly 60 Chinese language builders with excellent greenback debt might find yourself completely frozen out of worldwide finance, additional weakening deal movement.

The banker added that whereas traders had been braced for a missed fee by Evergrande for months, a sudden default final week by luxurious developer Fantasia “was an actual shock to the market”.

An ICE index monitoring Chinese language company issuers in Asia’s high-yield bond market demonstrates the dimensions of market contagion. The efficient yield on the index has shot as much as 24 per cent this week from 10 per cent in June, after fears of defaults spiralled throughout the developer property sector.

A broader index for all Asian high-yield debt, the place Chinese language builders are among the biggest borrowers, is buying and selling at 15 per cent, in contrast with 12 per cent on the finish of September.

Analysts at credit standing company Fitch estimated that excellent cross-border bond issuance by China’s actual property sector totalled $232bn on the finish of September, virtually a 3rd of which is anticipated to mature earlier than the top of subsequent yr. They attributed an increase in funding prices for Asian high-yield debt issuers within the third quarter primarily to “ongoing detrimental information regarding China Evergrande’s operations and potential default”.

“Worldwide traders are in all probability used to extra aggressive, intervention-style coverage,” the senior banker mentioned, pointing to an absence of sturdy assist from Beijing in current weeks for struggling builders. “They’re searching for kung fu however they’re getting tai chi.”

Bankers and traders mentioned issuance might return promptly if China stepped up policy support and inspired lending to builders — or it might stall for months, threatening to stall important refinancing offers throughout the sector.

One Hong Kong-based portfolio supervisor recommended that the specter of contagion to lenders that financed property teams would power policymakers to behave quickly.

“This might final a month, however I don’t see it lasting three or 4,” the portfolio supervisor mentioned. Chinese language authorities “need to stop spillover. For those who minimize off lending to builders lengthy sufficient, it additionally turns into a financial institution drawback.”

Sinic, one other developer, mentioned on Monday that it was unlikely to make payments on a bond due subsequent week, which was buying and selling at extremely distressed ranges of about 25 cents on the greenback.

Evergrande, which faces a $20bn pile of dollar-denominated debt, has missed 5 deadlines on funds to offshore bondholders. Kirkland & Ellis and Moelis, advisers to offshore bondholders, mentioned late final week that they’ve had no “meaningful engagement” from the corporate.

What’s in impact the closure of worldwide capital markets to Chinese language builders additional complicates their means to refinance, which has been cited by score companies in current downgrades of Evergrande and its friends. S&P recommended the Fantasia default was more likely to set off cross-defaults on its different debt.

“It might additionally speed up repayments on the corporate’s different debt,” the score company wrote. “Collectors could search early compensation owing to Fantasia’s deteriorating credit score profile.”

[ad_2]

Source