[ad_1]

With one yr earlier than the Chinese president is poised to safe an unprecedented third five-year time period, the stakes are excessive throughout what’s proving to be essentially the most consequential interval of his tenure.

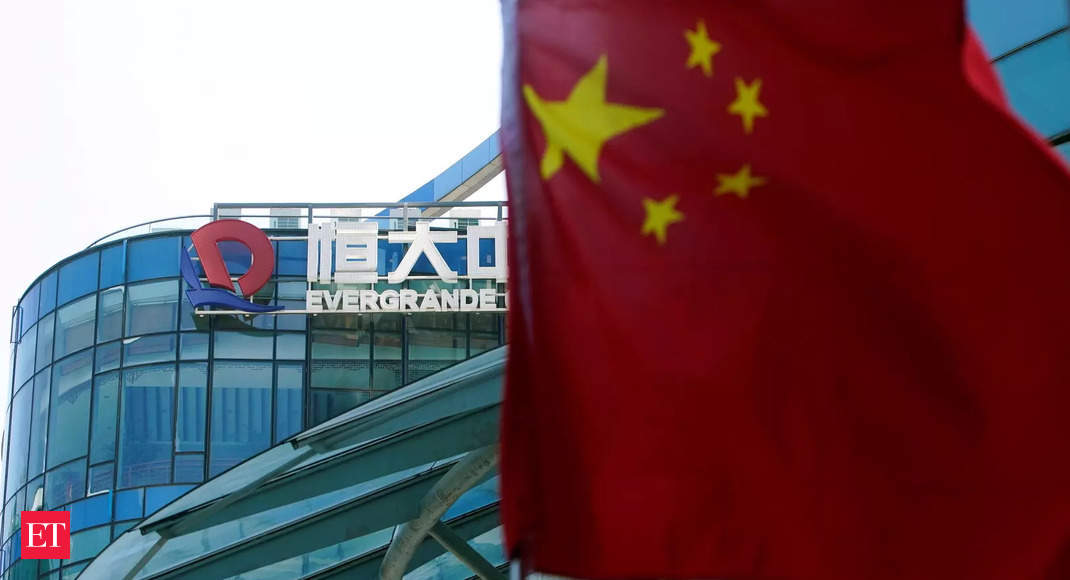

Evergrande’s borrow-to-build mannequin was enabled by a authorities reliant on property gross sales for income and unwilling to chew the bullet on runaway indebtedness for concern a collapse in costs would have devastating penalties for a rustic by which property accounts for 40% of family wealth, analysts, lecturers and economists say.

Xi, who has unleashed a spate of trade and societal reforms this yr within the title of “widespread prosperity”, has made clear that the excesses of many years of breakneck development powered by a relentless rise in property costs and debt should be delivered to heel.

However shared accountability for Evergrande’s disaster – and worries concerning the repercussions of a messy collapse – complicate choices on the destiny of a conglomerate with $305 billion in debt that’s scrambling to pay collectors, together with bondholders owed $83 million in a coupon cost https://www.reuters.com/world/china/china-evergrande-bondholders-limbo-over-debt-resolution-2021-09-24 that was due on Thursday.

“The federal government has to some extent triggered the issues at Evergrande,” stated Andrew Collier, managing director at Orient Capital Analysis, citing debt ratio caps, referred to as the “three purple strains”, positioned on builders in 2020 that put Evergrande below vital stress and compelled it to begin to promote belongings.

These caps adopted renewed official concern final yr over property sector froth after financial easing to cushion the impression of COVID-19 drove surging gross sales and indicators of speculative overbuilding by builders.

However clamping down on property costs is tough given the fiscal dependence on the sector. Native governments, which Orient Capital estimates account for 89% of whole authorities spending, derived greater than 40% of revenues from land gross sales in 2020, driving a codependent relationship with builders.

“(Builders) appear to get caught up within the political financial system … which successfully results in an incredible variety of unhealthy choices since you’re now making investments based mostly on political whim and political winds, somewhat than precise sound enterprise sense,” stated Fraser Howie, writer of a number of books about China’s monetary system.

China’s State Council Data Workplace didn’t instantly reply to a faxed request for remark.

DEEP ROOTS

The roots of the disaster date to tax reforms in 1994, which bolstered central authorities coffers however left native governments reliant on land financing for income, stated Alfred Wu, affiliate professor at Lee Kuan Yew College of Public Coverage in Singapore.

That triggered an increase in property costs and the expansion of builders like Evergrande, which thrived in third- and fourth-tier cities.

“Evergrande is a money cow for regional governments. If the corporate goes bust, the mannequin of land-financing and regional governments will go bust, too. The central authorities will not permit that,” Wu stated.

Regardless of years of warnings from some quarters concerning the enterprise mannequin utilized by Evergrande and others, which has included taking up heavy debt to spur land and undertaking acquisitions, the corporate was hardly a rogue operator.

Chairman and majority shareholder Hui Ka Yan https://www.reuters.com/world/china/evergrandes-billionaire-boss-exudes-calm-debt-risks-grow-2021-09-01 took pains to point out off his shut alliance with Beijing and the ruling Communist Social gathering, and was reciprocated.

Included in a listing of Hui’s achievements in Evergrande’s 2020 annual report are being named a “nationwide mannequin employee”, an award-winning poverty fighter and an “Wonderful Builder for the Socialist Trigger with Chinese language Traits”.

GREAT AWAKENING

Stability-obsessed Beijing is properly conscious that the rise within the housing market created not solely nice wealth however deep inequality.

One portfolio supervisor based mostly outdoors China who declined to be recognized stated the 2019 anti-government protests in Hong Kong, blamed partly on inequality fuelled by sky-high housing prices, have been a wake-up name for Beijing.

This yr, Xi has got down to reform the “three enormous mountains” https://www.reuters.com/world/china/no-gain-without-pain-why-chinas-reform-push-must-hurt-investors-2021-07-28 of housing, schooling and healthcare to rein in hovering prices for metropolis dwellers as a option to shore up legitimacy because the “folks’s chief”, analysts stated.

Protests by disgruntled suppliers, dwelling patrons and traders final week illustrated discontent that might spiral within the occasion a default sparks crises at different builders.

UBS estimated there are 10 builders with doubtlessly dangerous positions accounting for mixed contract gross sales of 1.86 trillion yuan ($287.92 billion), practically thrice Evergrande’s whole.

Nonetheless, many analysts say a wider disaster is unlikely, predicting that authorities would select a route of compressing the general property sector whereas addressing particular person issues as they come up.

“The federal government is aware of that if it would not deal with Evergrande fastidiously and lets it go bankrupt, disgruntled householders and shareholders might trigger social instability, mortgage defaults might result in monetary threat, large layoffs might add to employment woes, and personal companies could possibly be additional spooked,” stated Tang Renwu, who heads the College of Public Administration at Beijing Regular College.

[ad_2]

Source