[ad_1]

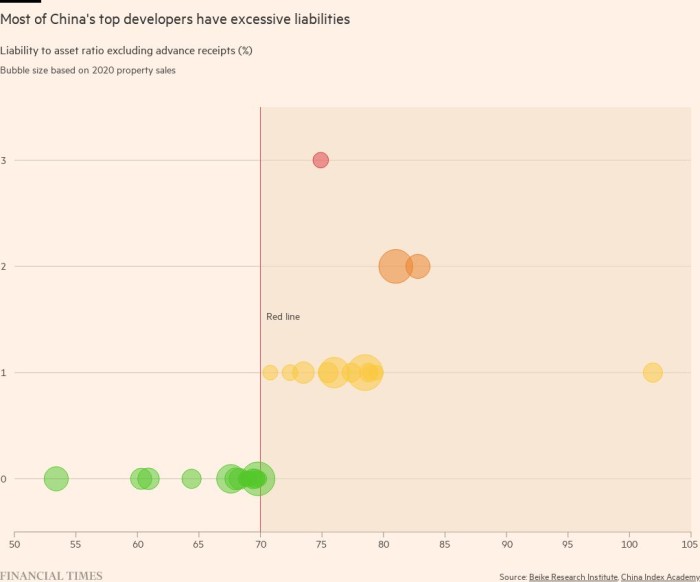

Nearly half of China’s 30 largest builders have been in breach of at the very least one in every of Beijing’s not too long ago launched guidelines on property sector leverage, in accordance with a Monetary Instances evaluation of the most recent accessible knowledge.

In August final yr, the Chinese language authorities unveiled the “three red lines”, which purpose to constrain property builders’ debt in accordance with three stability sheet metrics: the ratio of liabilities to property; web debt to fairness; and money to short-term borrowings.

The FT evaluation, primarily based on knowledge from Beike Analysis, a part of Chinese language property group KE Holdings, confirmed that among the many 30 builders, 14 had breached at the very least one purple line as of June 14. These firms accounted for almost all of the 30 builders’ gross sales final yr.

The findings come as Chinese language group Evergrande, the world’s most indebted developer, teeters on the sting of default after lacking an curiosity fee final month.

Evergrande’s issues have thrust China’s deleveraging coverage into the highlight and convulsed world markets. The corporate is essentially the most excessive instance of the excessive leverage that has for years funded Chinese language actual property improvement — and underpinned the nation’s speedy development — and which the federal government is now in search of to rein in.

Only some of the 30 builders within the FT evaluation had violated two or extra purple strains however liquidity crises at these firms, together with Evergrande and Guangzhou R&F, have raised issues about contagion to China’s wider economic system

If builders breach the foundations, they face caps on their potential to boost new debt.

S&P World Rankings famous that whereas the Chinese language authorities has not launched an official assertion relating to the foundations, they’ve been broadly reported in home media since final summer time.

Legal responsibility to asset ratio (excluding advance receipts)

The legal responsibility to asset ratio is the leverage metric that catches out by far essentially the most of China’s largest property builders, reflecting the size of not solely their debt but additionally obligations to the companies with which they work.

Nation Backyard Holdings, China’s largest developer by gross sales final yr, had a legal responsibility to asset ratio of 78.5 per cent as of June, surpassing the purple line restrict of 70 per cent. The group’s shares have slumped 26 per cent this yr, however its bonds maturing in 2024 are buying and selling increased than their par worth, in sharp distinction with a lot of its friends.

Of Evergrande’s nearly Rmb2tn of complete liabilities, practically half are made up of trade and other payables.

Many builders even have off-balance-sheet obligations that stand to extend their leverage if included in metrics.

Throughout the sector, firms usually promote properties forward of completion to homebuyers and obtain the fee prematurely, known as advance receipts. Builders add “contract liabilities” to their stability sheets to counteract the money that has are available, earlier than ultimately realising a revenue after the tasks are accomplished.

Internet gearing

Guangzhou R&F, the one Chinese language developer that had crossed all three purple strains, performs the worst on the subject of web gearing.

The metric subtracts an organization’s money holdings from its debt, then measures the distinction towards shareholders’ fairness. It is a means of evaluating indebtedness with the worth of a enterprise.

Apart from Evergrande, Guangzhou R&F has been one of many builders to return below essentially the most scrutiny. This yr, it accomplished the sale of a giant logistics improvement in south China to Blackstone, the US personal fairness agency. It has additionally bought property to Nation Backyard.

Its bonds have bought off sharply in latest weeks, however they rebounded after shareholders injected funds, which Fitch expects will likely be used to repay upcoming bonds.

Money to short-term debt ratio

Maybe essentially the most easy metric of builders’ vulnerability is how a lot money the corporate has available to repay money owed about to return due — and lots of are near the road, placing strain on their potential to make repayments.

Evergrande, the second-worst offender by this measure as of the top of June, has tried to boost money by offloading property, a few of which it listed in an interim report in August that additionally warned of the danger of default.

However its liabilities dwarf the property it has managed to promote. Evergrande’s stock is suspended together with that of its property administration subsidiary, which it listed in Hong Kong late final yr. On Monday, the developer stated it was anticipating a possible takeover provide for the unit.

One other latest sale, of a part of a stake in Shengjing Bank, highlighted collectors’ scramble to recoup losses from the teetering developer: the financial institution demanded that proceeds from the sale be used to repay liabilities it’s owed by Evergrande.

[ad_2]

Source