[ad_1]

Low costs made Uber into a world sensation. Now they threaten its future. Low-cost fares stored the ride-hailing app on the highway by means of its worst years, regardless of accusations of aggressive rule-breaking, a belligerent founder and friction with drivers. However because the monetary credibility of its disruptive enterprise mannequin is carrying skinny, the period of Silicon Valley-backed development in any respect prices is at an finish.

Uber is an organization valued at $91bn that also loses cash. For greater than a decade, traders have accepted billions of {dollars} of loss. Not for for much longer. Uber is pledging to stability the books. Because the begin of the pandemic it has shed its experimental driverless automobile and vertical lift-off plane models, offloaded bikes and scooters and diminished headcount by round 25 per cent.

Costs for patrons are rising too. Uber, an organization born within the midst of the monetary disaster, is attempting to ship earnings simply because the labour market is in flux. To the dismay of customers, extremely low-cost companies are rising extra expensive.

To this point, the mix of value cuts, effectivity and better charges is working. In September, Uber declared that it might quickly report a constructive adjusted ebitda determine — a self-defined measure of profitability. The market response was euphoric. The corporate’s inventory worth jumped 11 per cent on the day. Dara Khosrowshahi, Uber chief executive, describes its stability sheet as “nice”.

If Uber is about to finish a decade of losses and mark the beginning of a profitable future it will likely be top-of-the-line turnround tales within the tech business. However adjusted figures may be deceptively optimistic.

Trip sharing in a pandemic

In idea, Uber ought to be low-cost to run. It doesn’t personal autos or immediately make use of the drivers who ferry passengers, meals and freight all over the world. Uber is only a platform — a dealer arranging offers between patrons and sellers for a price.

However the gig economy has proved more expensive than envisaged. The concept was that firms might flood the market with on-demand companies like laundry, meals supply, rides and repairs. They’d develop their buyer base by absorbing a few of the value of companies, counting on employees who weren’t staff and elbowing out rivals.

Silicon Valley enterprise capital supplied the rocket gas. Uber, which began as a luxurious automobile service app in San Francisco, grew into a world transport enterprise with freight, meals and grocery deliveries. Greater than 100m folks use the platform each month.

Sadly, competitors has proved relentless. Within the US alone, Uber continues to be locked in a battle with Lyft for rides and DoorDash for meals deliveries, amongst others. It can not danger eradicating subsidies utterly. In April, the corporate introduced that it might must spend one other $250m on incentives to ward off a driver shortage.

Costs are a fragile calculation. Too excessive and passengers will cancel. Too low and drivers will discover different work. Plus Uber has to strike the appropriate stability with the share of charges it takes.

There’s a additional drawback. If drivers get hold of the worker standing that many are combating for — and which some nations and states are demanding — future profits could evaporate. Uber claimed costs might double if it was topic to a California invoice that sought to reclassify some gig workers as employees. It’s nonetheless exempt regardless of a California choose ruling that the regulation classifying gig employees as impartial contractors was unconstitutional. Within the UK, a Supreme Courtroom ruling in February guaranteed holiday pay and a minimum wage to the drivers who had introduced the case. Within the first quarter of the 12 months Uber reported a $600m accrual because of that single change.

The enterprise continues to be recovering from the pandemic, which put a cease to automobile sharing and blew a gap in revenues. Passengers are returning. However as Uber focuses on earnings, costs in some cities are noticeably greater. 5 years in the past, an Uber trip in London was round a 3rd cheaper than for a standard black cab. Now the costs are comparable, relying on demand. Uber’s cheaper “pool” possibility, during which a number of riders share a visit, was suspended through the pandemic and is barely slowly returning.

Retaining rivals at bay

Uber’s increasing meals supply enterprise — starting from quick meals to neighbourhood eating places — cushioned the corporate from the drop in passenger demand through the pandemic. Final 12 months it overtook rideshare as the corporate’s largest income. Khosrowshahi believes that habits shaped in lockdown will stay in place lengthy after reopenings.

However meals supply is a drag on profitability. There was consolidation in some areas — within the US Uber acquired rival firms together with alcohol supply service Drizly and meals supply firm Postmates. To interrupt even, Uber should nonetheless both take a better share of every order or group extra orders into single journeys, lengthening supply occasions.

Meals retailers, akin to Hanson Li, co-founder of Lazy Susan, a delivery-only Chinese language restaurant in Hayes Valley, an prosperous neighbourhood of San Francisco, have been working with Uber Eats for a while. The dishes he sells are ready to deal with bumpy rides. “It’s bought that crunch, proper? It’s not soggy,” he says of his signature garlic and basil hen wings. “We spent a number of time designing hen wings that will stand up to journey.”

Lazy Susan makes use of empty kitchen area in a restaurant that closed through the pandemic, however Li says supply prices are nonetheless too excessive. “The buyer receipt is beginning to seem like a rental automobile settlement,” he says, referring to the rising variety of line objects on a typical Uber meals supply receipt, together with regulatory charges, San Francisco-specific tax measures and different prices — not together with a tip.

Like each restaurant proprietor within the metropolis, Li is wanting intently at how these prices stack up, and whether or not supply firms like Uber would possibly flip the screw with a view to make their very own companies worthwhile.

Up to now, meals supply firms have been identified to cost as a lot as 30 per cent fee to eating places on every order. In San Francisco they’ll now cost a most of 15 per cent, after metropolis supervisors voted to take care of a pandemic-era cap on commissions. New York Metropolis not too long ago handed a invoice to make a 23 per cent cap everlasting.

Alongside the continued battle over driver worker standing, battling fee caps in several markets shall be a big function of Uber’s exercise in 2022.

Whereas Uber is pulling out the stops to compete toe-to-toe with world meals supply firms, there’s one space the place the corporate is joyful to sit down again and let others plough billions of {dollars} into investments: rapid grocery services. Over the previous 12 months, DoorDash has expanded its community of US “DashMart” warehouses, whereas small however heavily capitalised players like Gopuff have promised all method of comfort objects in half-hour or much less from purpose-built services.

Uber limits its grocery supply affords to present shops. “We don’t assume we will add an enormous quantity of worth in working a retailer,” Khosrowshahi says. “That’s not the place the magic occurs. So we are going to accomplice with consultants in working a retailer or restaurant.”

These partnerships embody integrating Gopuff into the Uber Eats app, a transfer each events say leaves sufficient margin to make it worthwhile.

“The hazard to Uber is that if all they do is accomplice with consultants, it opens the door for DoorDash, Shipt, Instacart or any of the speedy grocery supply firms to chop a take care of Uber’s grocery, retail and restaurant prospects,” says Brittain Ladd, a guide specialising within the grocery sector. “I’m not satisfied that Uber gained’t open its personal automated darkish shops to supply ‘fulfilment by Uber’.”

The correct route?

Growth comes at a worth. Regardless of reducing prices, Uber recorded a $6.8bn internet loss final 12 months.

Though it jettisoned some lossmaking elements of the corporate, it has held on to its rising Freight enterprise. In 2020, income for the freight division, which matches truckers to cargo by reducing out brokers, exceeded $1bn.

Within the tech business, heavy losses should not essentially an indication of failure. However Uber’s early traders, the chance takers like VC agency Benchmark Capital which might be tolerant of the growth-at-all-costs mannequin, have largely departed. To warrant its market worth, Uber has to show that its underlying enterprise can become profitable.

Roger McNamee, a veteran tech investor, is sceptical. “The three values of the post-2010 Silicon Valley — effectivity, velocity, and scale — laid the muse for predatory enterprise fashions,” he says. “The notion was to boost a lot capital and transfer so quick that your organization turned a self-fulfilling prophecy.” A number of the firms that adopted this mannequin have grow to be actual, worthwhile companies. However not all.

Uber’s profitability is a shifting goal. It managed to report $1.1bn of revenue within the final quarter to June 30. However this determine was boosted by excessive valuations of its investments in different firms, together with a $1.4bn unrealised achieve from its stake in Chinese language ride-hailing firm Didi. These paper positive aspects produced no onerous money.

Didi’s share worth has since crashed, following China’s decision to investigate its handling of personal data. This can drag on Uber’s earnings.

Khosrowshahi is evident that one-off profitability shouldn’t be what Uber desires. “We’re after sustainable, free money circulation technology — GAAP profitability [numbers that comply with generally accepted accounting principles] with very huge top-line development, over a five- to 10-year interval,” he says. “That’s the objective right here. And you already know, you solely get there by constructing an important firm that’s providing unbelievable companies to folks all all over the world. And that’s the place it begins, and that’s the place it ends.”

However a take a look at Uber’s enterprise operations reveals that the losses are stark. Within the first six months of the 12 months, free money circulation was minus $1.1bn.

Uber prefers to direct traders in the direction of one other quantity: adjusted ebitda, or adjusted earnings earlier than curiosity, taxes, depreciation and amortisation. It sees this as an excellent proxy for the profitability of core companies as a result of it excludes non money bills and one-off prices. Within the final quarter the quantity was minus $509m. Within the subsequent quarter, Uber says it may very well be constructive.

Adjusted numbers are standard with US firms as a result of they permit them to create bespoke metrics. Firms say they’ll present a clearer image of how the enterprise works. Mentions of adjusted ebitda throughout S&P 500 firm earnings calls are up greater than 50 per cent since 2015, in response to Zion Analysis Group. Many look higher than normal numbers.

Angelo Zino, an analyst at CFRA, an funding analysis agency in New York, believes Uber’s adjusted ebitda determine demonstrates the corporate is heading in the right direction. “Optimistic money circulation and GAAP profitability are extra essential, however this exhibits issues are shifting in the appropriate route,” he says.

However Uber’s adjusted ebitda determine excludes stock-based remuneration, which was $272m within the final quarter. Dave Zion at Zion Analysis factors out that in a tech firm like Uber, inventory based mostly compensation is a really actual value of doing enterprise because it types a good portion of worker pay. “Take away the inventory compensation then see what number of staff depart and the way the enterprise runs,” he says.

Stability over ambition

Since ousting founder Travis Kalanick in 2017, Uber has efficiently shed the worst of its picture. Underneath Khosrowshahi it has morphed from a ruthless start-up with a poisonous work tradition right into a sober, public firm. A current profile described the chief govt because the “dad of Silicon Valley”.

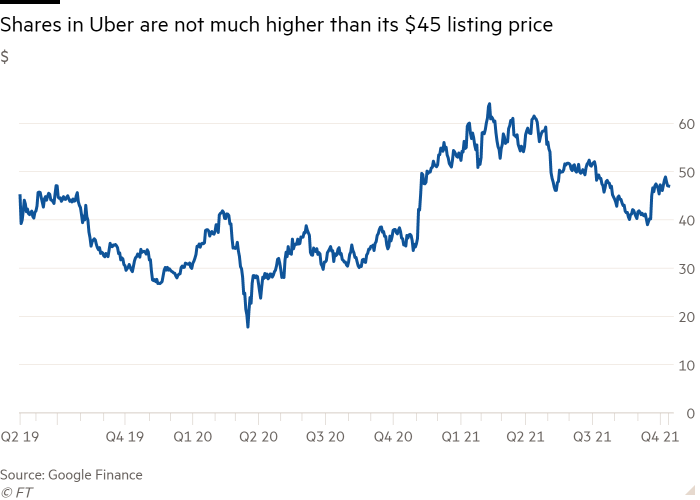

However Khosrowshahi has not been in a position to erase all of Uber’s issues. The share worth hovers near its 2019 itemizing of $45. The way forward for gig employees poses an existential risk. Chief authorized officer Tony West, brother-in-law of US vice-president Kamala Harris, led a profitable marketing campaign that exempted Uber drivers from California’s gig employee invoice. However a number of states and governments stay sad that drivers are classed as self-employed, and proceed to work on legislative measures designed to shut what they see as an employment loophole.

Within the US, a labour scarcity and rising demand has created an costly drawback. Flexibility, touted by Uber as a key incentive for drivers, shouldn’t be sufficient. Drivers need higher remuneration.

However as long as they don’t grow to be staff, Uber is forecast to report constructive ebitda on a non-adjusted foundation by subsequent 12 months. This, says Zino at CFRA, might result in heightened scrutiny from regulators. “My concern is that it’d show an excessive amount of of an excellent factor,” he says. “Regulatory points could enhance because it turns into extra worthwhile.”

The wild card stays robotic taxis, as soon as seen as the reply to Uber’s labour and wage issues. Failure to supply autonomous autos is listed as a danger issue within the firm’s most up-to-date annual report — although exams had been halted after the loss of life of a pedestrian in 2018.

The price of growing autonomous autos shall be huge. So will the price of shopping for, renting and insuring them. Uber’s resolution to sell its driverless cars unit to Aurora, whereas taking a 26 per cent stake within the enterprise, is wise for the corporate’s money circulation. But it surely additionally removes a few of the distinctive innovation that helps outsize valuations in tech. Uber has chosen stability over anarchic ambition. Buyers are left to determine whether or not a transportation firm that’s nonetheless a 12 months away from ebitda break-even is price $91bn.

[ad_2]

Source