[ad_1]

Merck’s most cancers immunotherapy Keytruda is a surprise drug that has remodeled not simply the survival odds of hundreds of sufferers but additionally the pharmaceutical firm’s fortunes. Nevertheless, with the drug poised to lose patent safety in 2028, recently-appointed chief government Rob Davis should discover new therapies to plug an eventual decline in gross sales when rivals launch cheaper variations.

Final week buyers noticed the primary glimpse of Davis’s technique when Merck agreed to pay $11.5bn for Acceleron Pharma, a biotech firm that develops protein-based therapies to deal with a uncommon blood strain dysfunction and a few cancers. Davis mentioned the deal would assist to diversify Merck’s portfolio and that he was scouring for different targets to assist the corporate deal with the looming patent cliff.

“I’m assured we’ve got the firepower, the aptitude, the main focus and urgency to do this,” Davis advised the Monetary Instances. “This is step one on a journey to proceed to construct out our pipeline in order that we’ve got the flexibility to develop sustainably properly into the subsequent decade . . . We gained’t be restricted by the steadiness sheet.”

Davis, who changed veteran Merck CEO Kenneth Frazier in July, advised buyers final week that he would settle for a one-notch credit standing downgrade if he wanted to spend large to safe the suitable goal.

Though 2028 may sound like a great distance off, it’s a comparatively brief time in “pharma years” on condition that it takes on common a decade and $2.6bn of funding to take a brand new drug from preliminary discovery to {the marketplace}. Only one in eight medicine that enters scientific trials is finally authorized, in response to business estimates.

Merck, a $213bn firm with a portfolio spanning human and animal well being, isn’t alone in dealing with a patent cliff. Pfizer, AbbVie and Bristol-Myers Squibb all have blockbuster medicine on account of lose exclusivity quickly and have not too long ago sealed multibillion-dollar offers.

Nevertheless, Merck’s shares have lagged most of its friends over the previous 18 months on account of issues about its reliance on Keytruda and a failure to launch any Covid-19 vaccines or therapies. On the Covid entrance, the corporate seems finally to be on the cusp of success after the publication on Thursday final week of constructive knowledge from a scientific trial of an antiviral pill, which prompted its shares to leap virtually 9 per cent to $81.60.

The Covid drug, molnupiravir, decreased the chance of hospitalisation or demise by roughly 50 per cent in comparison with placebo within the trial. If authorised it will be the primary oral tablet given to sufferers quickly after analysis and SVB Leerink, an funding financial institution, forecasts it might internet $12bn in cumulative gross sales by the tip of 2025.

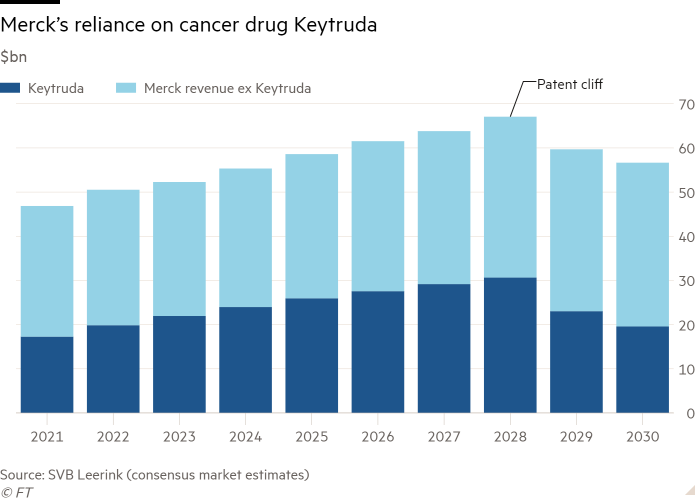

However that isn’t sufficient to switch Keytruda, which has remodeled Merck, bringing in slightly below a 3rd of the corporate’s whole income of $48bn final 12 months. SVB Leerink predicts that the proportion will solely develop as the corporate lurches in direction of patent expiration, with the most cancers drugs accounting for greater than half of gross sales by 2028, when it should face the specter of competitors from cheaper options.

PlantForm, a Canadian biotech firm, and Sydney-based NeuClone Prescribed drugs are already working with companions in Brazil and India to launch “biosimilars” which might be virtually similar to Keytruda.

“You’ve among the best medicine in historical past and Merck seems to have a humiliation of riches. However [Keytruda] has develop into so large buyers fear actually early — on this case seven years from now — how the corporate will fill the income hole,” mentioned Daina Graybosch, analyst at SVB Leerink.

A number of the investor panic surrounding the patent cliff is overdone given the efforts Merck has made to mix Keytruda with different medicine to deal with a protracted listing of cancers, a course of that may lengthen a medication’s longevity. “There’s a notion on the market that Keytruda income will simply fall off put up 2028 however that isn’t going to occur,” Graybosch mentioned.

Merck has filed 129 patents linked to Keytruda, which might lengthen the interval of exclusivity to 2036 and past, in response to analysis by the Initiative for Medicines, Entry & Data, a non-profit group that campaigns for cheaper medicine. Keytruda will value the American healthcare system about $137bn throughout that eight-year interval, I-MAK claims.

Nonetheless, Merck’s failure to start diversifying its portfolio away from Keytruda extra shortly has unnerved buyers. Final month Morgan Stanley downgraded Merck to equal weight from chubby, and decreased its worth goal on the corporate from $90 to $85.

“Traders need to see that you’ve a few property which might be going to develop by way of the patent cliff,” mentioned Matthew Harrison, an analyst at Morgan Stanley, who welcomed Davis’s renewed give attention to “enterprise improvement”.

Acceleron is growing sotatercept, a possible blockbuster drug to deal with pulmonary arterial hypertension, a illness attributable to excessive strain within the blood vessels main from the guts to the lungs. As a result of it’s in late-stage scientific trials, the corporate has comparatively excessive confidence it could actually launch the drug in 2024-25 and generate income forward of Keytruda’s lack of exclusivity.

“It is a 2025 product — in order that they [Merck] may give buyers some confidence concerning the progress fee of the enterprise. It’s a step in the suitable path but it surely doesn’t clear up the entire downside,” Harrison mentioned.

Like all giant pharma corporations, Merck’s enterprise improvement crew maintains a protracted listing of potential targets, starting from smaller biotechs with thrilling however unproven medicine to bigger corporations with medicines already in the marketplace or which have proven promise in human trials.

Mirati Therapeutics, a clinical-stage biotech firm with a market worth of $8bn that’s targeted on therapies for lung most cancers, is one attainable goal, in response to folks briefed on the matter. Strand Therapeutics, a developer of mRNA therapeutics for most cancers immunotherapy, and Arcturus Therapeutics, which is utilizing mNRA to fight cystic fibrosis, are additionally potential targets, the folks mentioned.

However putting bets on early stage corporations is a high-stakes sport and a few buyers need to see Merck put money into later stage corporations resembling Acceleron, which might generate income extra shortly. The US biotech large Biogen, which gained US approval for its Alzheimer’s drug Aduhelm in June, might additionally develop into a possible goal for Merck regardless of its market capitalisation of $41bn, in response to folks near Merck.

However others consider Davis is unlikely to pursue the kind of megamerger that would trigger integration issues or invite scrutiny from world regulators, who introduced in March a review into whether or not large pharma offers are decreasing competitors out there for prescribed drugs.

“Merck is the accountable dad of huge pharma and they’re going to do issues the suitable manner,” Graybosch mentioned. “They don’t do issues to make a giant splash and by way of doing offers like Acceleron they gained’t overpay . . . That’s the tradition at Merck and I don’t see the brand new management altering that.”

[ad_2]

Source