[ad_1]

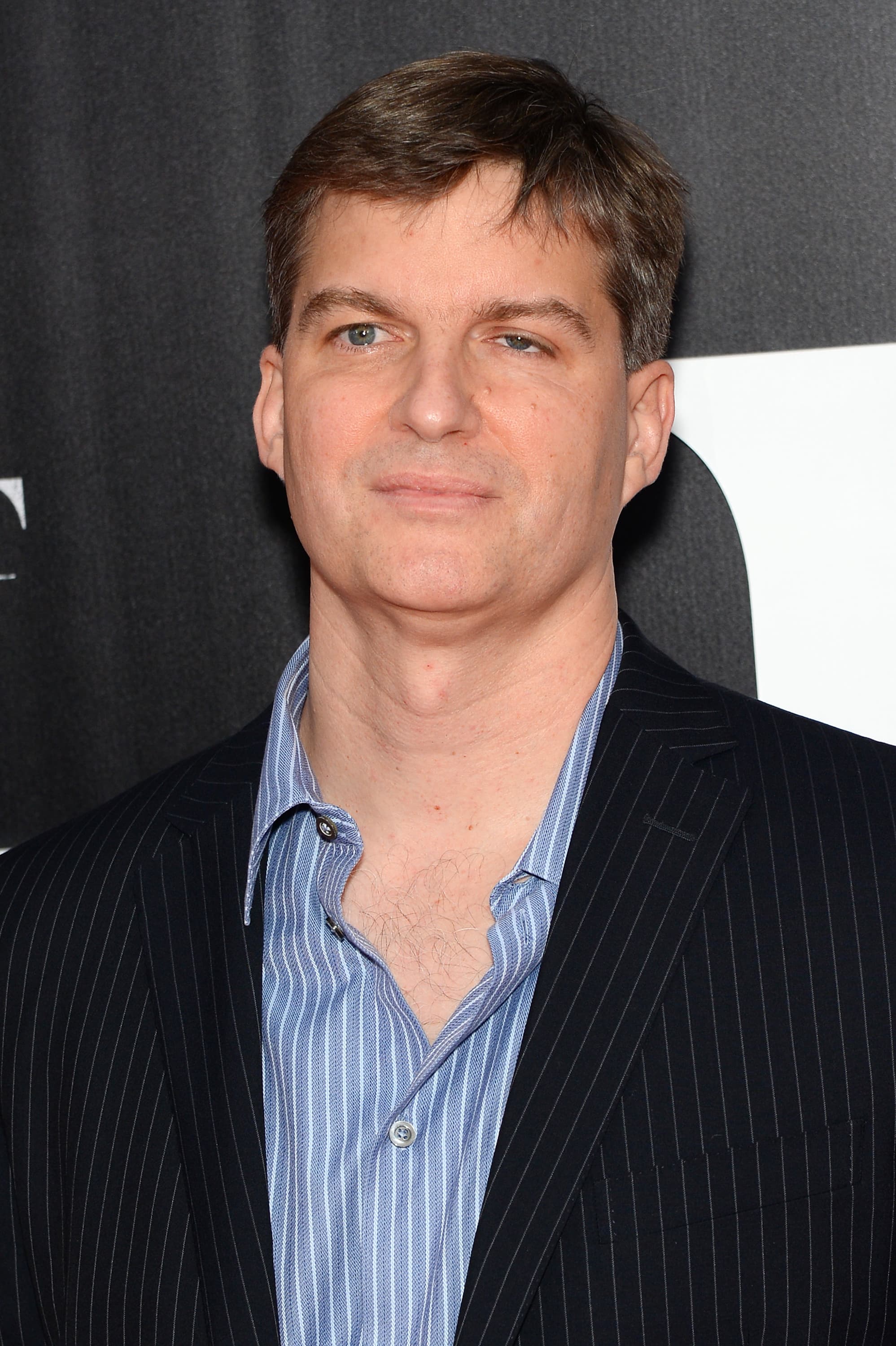

Andrew Toth | FilmMagic | Getty Pictures

“The Massive Quick” investor Michael Burry inquired about methods to wager towards bitcoin simply earlier than the world’s largest cryptocurrency hit a six-month excessive to breach the $60,000 stage.

“Okay, I have never completed this earlier than, how do you brief a cryptocurrency,” Burry mentioned in a Wednesday tweet. “Do it’s a must to safe a borrow? Is there a brief rebate? Can the place be squeezed and known as in? In such risky conditions, I are likely to suppose it is best to not brief, however I am considering out loud right here.”

Bitcoin topped $60,000 on Friday, notching its highest stage since April 17. Buyers and analysts are optimistic that U.S. regulators may give the inexperienced mild to the primary bitcoin futures exchange-traded fund as soon as next week. Such a transfer would give mainstream traders publicity to the crypto market, which permits for even better acceptance of digital property on Wall Avenue.

The famed investor has been a vocal critic of cryptocurrencies, taking situation with their wild volatility and speculative buying and selling actions. He beforehand in contrast bitcoin to the 2007 housing bubble, which he had wager towards and profited from immensely.

“MSCI says there may be $7.1 trillion in market cap tied to shares of firms holding crypto. However MSCI additionally says solely 79 folks of 6,500 company board members have crypto experience. That is, as they are saying, a function, not a bug,” he mentioned in a now-deleted tweet Thursday.

Over the previous week, Burry additionally known as meme token Shiba Inu “pointless.”

Burry was one of many first traders to name and revenue from the subprime mortgage disaster. He was depicted in Michael Lewis’ ebook “The Massive Quick” and the following Oscar-winning film of the identical title. Burry now manages about $340 million at Scion Asset Administration.

Burry said in an email exclusively to CNBC that he isn’t shorting cryptocurrencies, however that he does consider they’re in a bubble.

The investor routinely deletes and makes non-public his Twitter account underneath the deal with @michaeljburry. Over the previous week, he reactivated his account and made it public. In his latest tweetstorm, he commented on a spread of subjects from taxing the wealthy, to the Federal Reserve and former President Donald Trump. It appeared that Burry deleted his account once more Friday.

Loved this text?

For unique inventory picks, funding concepts and CNBC world livestream

Join CNBC Professional

Begin your free trial now

[ad_2]

Source