[ad_1]

Obtain free World inflation updates

We’ll ship you a myFT Day by day Digest electronic mail rounding up the most recent World inflation information each morning.

Provide chain disruptions sweeping main economies have reawakened an previous nemesis for buyers: stagflation.

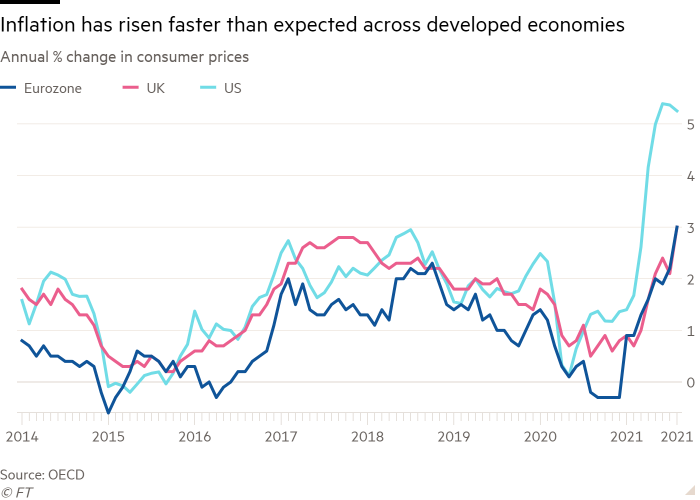

Nervousness over rising inflation has been ever-present in markets this yr. However with oil topping $80 a barrel, world meals costs a 3rd costlier than they had been a yr in the past and different commodities at decade highs, buyers say a longer-than-expected inflationary surge is coinciding with a slowdown in progress — and making it worse.

Economists and buyers play down comparisons with the aftermath of the Nineteen Seventies oil shock, which gave rise to the time period “stagflation”. Then, inflation and rates of interest bumped into double digits, unemployment soared and GDP recovered solely slowly from repeated setbacks.

However with power payments now rocketing, many fear a couple of progress slowdown at a time when central banks are edging in direction of lifting rates of interest in a bid to maintain a lid on longer-term inflation.

“The dialog round inflation has positively shifted,” mentioned Seema Shah, chief strategist at Principal World Buyers. “There’s nonetheless a broad settlement that numerous it’s transitory, however we nonetheless suppose it’ll final properly into 2022 and actually begin to hit shopper spending.”

“It’s not the Nineteen Seventies, however that is modern-day stagflation.”

Indicators from the Federal Reserve and Financial institution of England final week that they may quickly start lifting charges have fuelled a big bond sell-off over the previous week and a half. However in distinction to the “reflation” commerce at first of this yr, shares have been unable to attract consolation from the prospect that tighter financial coverage can be accompanied by accelerating progress.

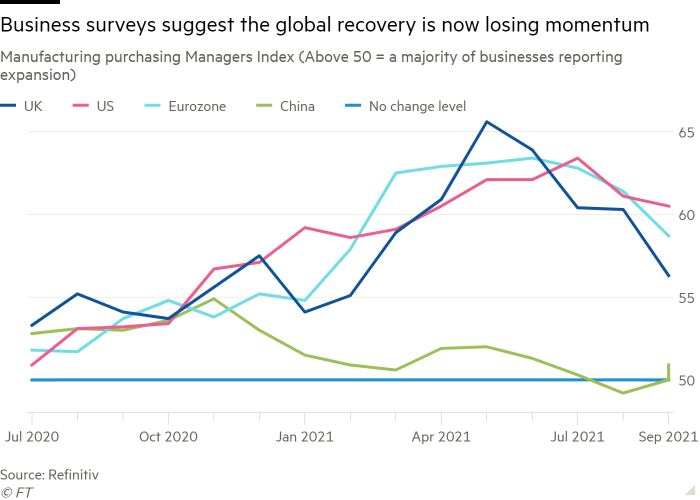

Ample proof means that the provision shock reverberating world wide, mixed with outbreaks of the Delta variant of coronavirus, is tempering the restoration in progress.

Knowledge launched this week pointed to a pointy slowdown in Chinese language manufacturing, as regulatory pressures and excessive power costs shut down some manufacturing. Enterprise surveys from the US, UK and eurozone recommend that exercise has slowed as supply occasions lengthened and backlogs constructed up.

Promoting exercise spilled over into fairness markets this week after information confirmed that US shopper confidence had dropped to a six-month low in August.

The UK has discovered itself on the sharp finish of stagflationary considerations, with a surge in power costs compounded by driver shortages that left petrol pumps operating dry.

Whereas revised information present exercise bounced again quicker than thought over the summer time, the restoration now seems to be faltering. The Financial institution of England’s governor Andrew Bailey acknowledged this week that provide bottlenecks and labour shortages had been worsening, and will maintain down progress and gasoline inflation for some months to return.

“The restoration has slowed and the economic system has been buffeted by extra shocks,” he mentioned in a speech to the Society for Skilled Economists.

Considerations over progress are one motive the pound has not benefited from a pointy rise in UK authorities bond yields, as they usually do, after Bailey signalled {that a} fee rise may come as quickly as this yr. As a substitute, sterling has slumped to its lowest degree of 2021 towards the greenback, as some buyers concern that early fee will increase may choke off a fragile restoration.

“Whether it is stagflation, central banks are in a bind,” mentioned Jim Leaviss, head of public fastened earnings at M&G Investments. “Mountaineering will cut back demand a bit bit and strengthen the foreign money. However it’ll haven’t any influence on provide chain points [ . . .] it gained’t carry again lorry drivers.”

That dilemma — shared by different massive central banks — may threaten buoyant fairness markets, based on Mohamed El-Erian, chief financial adviser at Allianz.

“Central banks can be torn between reacting to the ‘stag’ and the ‘flation’,” he mentioned. “That’s a world the place buyers’ confidence in policymakers is shaken, and the backstop they’ve had over the previous decade isn’t there any extra.”

Vicky Redwood, senior financial adviser at consultancy Capital Economics, mentioned the UK’s “stagflation lite” was seen in lots of nations — with the surge in inflation coming earlier within the US, however progress now slowing there too because of the unfold of the Delta coronavirus variant.

However inflation ought to begin to ease in 2022 and the state of affairs was nonetheless “a great distance off something just like the Nineteen Seventies,” she mentioned, including: “we gained’t see inflation get into the system like we did then.”

Others warn, nonetheless, that there isn’t a signal but of the strains on provide chains easing, and that the world could possibly be heading for a extra sustained interval of tepid progress and better inflation than policymakers have been predicting.

“It’s a world downside,” mentioned Kallum Pickering, economist at Berenberg, arguing that corporations had little visibility over “very difficult provide chains” and disruption may final for much longer than thought.

If provide chain issues continued for an additional six to 12 months, whereas customers nonetheless had job safety and had been prepared to pay for the products they wished, he mentioned: “the whiff of stagflation may be extra of a stench”.

Extra reporting by Federica Cocco

[ad_2]

Source