[ad_1]

China’s crackdown on international traders and home property hypothesis has prompted many worldwide traders to go for the exits. Ray Dalio isn’t amongst them.

As an alternative, the founding father of the $140bn US hedge fund Bridgewater Associates and some of the outstanding international traders within the nation, mentioned he has spoken on to officers from the Chinese language Communist celebration prior to now week, and been inspired by what he heard.

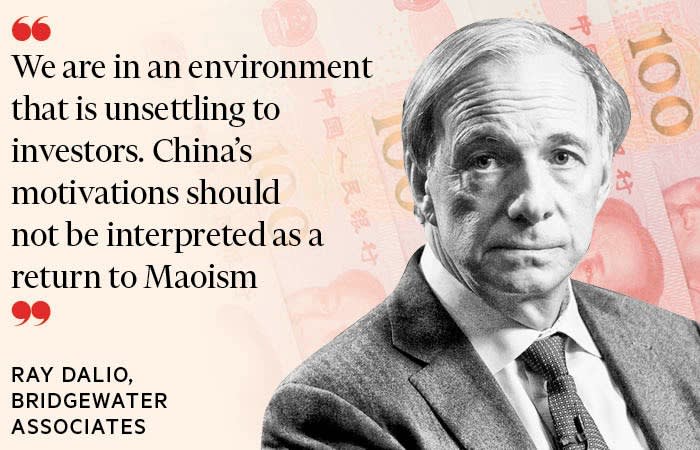

“At this stage I’m assured that this doesn’t imply foreigners and international traders will not be welcome,” mentioned the 72-year-old, who first visited China 37 years in the past. “We’re in an surroundings that’s unsettling to traders”, conceded Dalio. However “China’s motivations shouldn’t be interpreted as a return to Maoism”, he mentioned in an interview with the Monetary Occasions.

Beijing’s regulatory blows, focusing on sectors from video video games to training, have wiped greater than $1tn of market worth from Chinese language equities since their current peak in mid-February.

Goldman Sachs estimates {that a} additional $3.2tn of market capitalisation could possibly be uncovered to additional regulatory uncertainty — roughly a sixth of the market cap of all Chinese language listed firms.

However Dalio says Beijing is searching for the “widespread prosperity” set out in President Xi Jinping’s 14th five-year plan in March. It needs to right a interval when capitalism raised dwelling requirements but additionally created a “massive wealth hole” and “an excessive amount of debt”, he mentioned.

This week, traders in an offshore bond issued by property developer Evergrande have felt the sharp finish of Beijing’s interventions. By Friday afternoon, they’d nonetheless yet to receive a high-stakes curiosity cost that had fallen due yesterday.

The world’s most indebted property group has come underneath strain as authorities have cracked down on extreme debt within the sector. It has a 30-day grace interval earlier than any failure to pay formally ends in a default. A missed cost would kick off the biggest restructuring in China’s monetary historical past, in a sector that accounts for practically a 3rd of the nation’s financial system.

Famend brief vendor Jim Chanos warned this week that Evergrande’s disaster could possibly be “far worse” for traders in China than a “Lehman-type” systemic disaster as a result of it factors to the top of the nation’s property-driven progress mannequin. China would want to seek out “new progress drivers”, he added, “or downshift considerably semi-permanently right into a decrease degree of progress”.

Others have been extra sanguine, sustaining that authorities intervention in China is nothing new and doesn’t derail longer-term structural traits, corresponding to an rising center class of shoppers.

“It might be excessive and wrong-headed to treat China as uninvestable,” mentioned Fred Hu, chair and chief govt of Primavera Capital Group, and former head of China at Goldman Sachs. “In the identical approach, nobody might credibly declare Europe is uninvestable simply due to the euro debt and banking disaster or Brexit, or US off limits due to the subprime debt disaster.”

Nonetheless, it could be “enormously useful,” Hu added, “if the Chinese language authorities might attempt to enhance communications with traders and supply a higher diploma of coverage consistency and predictability”.

The Evergrande disaster and Beijing’s curbs have roiled markets in current months. However many international traders in China insist that their long-term time horizons assist them journey out short-term jitters.

“In contrast with the US, Europe and Japan, I consider China as an financial adolescent . . . tempestuous and unstable however its finest many years are forward,” mentioned Howard Marks, co-founder of distressed asset supervisor Oaktree Capital Administration.

“China is engaged on rising as a monetary participant on the worldwide stage inside the context of their ideology”, Marks added. “In the event that they act in an unpalatable approach in the direction of outsiders, they gained’t progress the way in which they wish to.”

‘Why would you put money into China?’

An abrupt and wide-ranging regulatory crackdown started final November when the $37bn blockbuster preliminary public providing of Chinese language funds group Ant was torpedoed on the eleventh hour by Beijing regulators. Subsequent got here anti-monopoly and information safety measures in opposition to a few of China’s largest tech firms, together with ecommerce group Alibaba, takeaway supply and way of life providers platform Meituan, and ride-hail app Didi Chuxing — previously standard picks within the world investor group.

As Xi tries to reshape the nation’s cultural and enterprise panorama as a part of a “widespread prosperity” drive, Beijing has imposed strict limits on the period of time younger folks can play video games. It has additionally banned the for-profit education sector and stepped up criticism of the cosmetic surgery business.

After the last-minute cancellation of the Ant IPO, Ben Rogoff, London-based director of Polar Capital’s expertise funds, reduce its positions in Alibaba and Tencent. “We’ve missed Chinese language shares prior to now, however that’s wonderful as a result of the political danger is greater than perceived,” mentioned Rogoff, whose funds at the moment are much more underweight China relative to their benchmark.

“In tech there are genuinely 1000’s of shares in our investable universe”, Rogoff added. “I can construct a portfolio with a 20-25 per cent progress trajectory with little direct publicity to China.”

Hedge fund supervisor Kyle Bass stopped investing in China 12 years in the past. After learning the nation’s banking system and the technique of coverage officers. “I made a decision it was a market that I’d by no means put money into,” mentioned the founding father of Dallas-based Hayman Capital Administration.

“A query for traders is why would you put money into China given all of the dangers. There is no such thing as a rule of legislation, there isn’t any fiduciary responsibility in the direction of traders, and no applicable degree of auditing for his or her firms.”

“China is rule by legislation however not rule of legislation,” added brief vendor Carson Block, Texas-based founding father of Muddy Waters Analysis. “I’m not going to be lengthy China as a result of the numbers will not be reliable and nothing about it’s reliable.”

However different traders view Xi’s “widespread prosperity” drive as a possibility to again sectors aligned with the federal government’s goals of constructing a fairer and extra productive financial system.

Within the view of those extra bullish traders, Xi is searching for to rebalance the financial system in the direction of consumption-driven progress, whereas addressing inequality and supporting industries corresponding to renewable energy, inexperienced manufacturing, healthcare, software program, synthetic intelligence and those who drive the ‘Made in China’ narrative. The commerce conflict with the US has accentuated the necessity to construct a home provide chain and cut back dependence on imports from the US.

At any fee, it helps to be aligned with Beijing’s agenda: “The lesson of investing in China is to be on the correct aspect of presidency coverage,” mentioned Justin Thomson, head of worldwide fairness at T Rowe Value.

Further reporting by Leo Lewis in Tokyo

[ad_2]

Source