[ad_1]

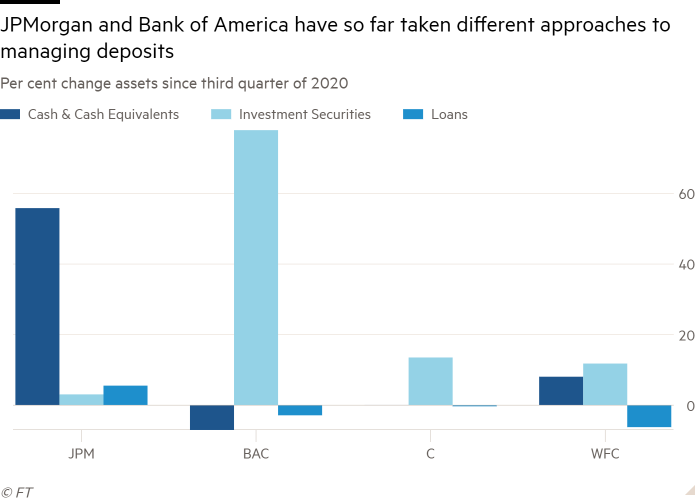

The largest US banks are pursuing dramatically completely different methods for deploying their trillions of {dollars} of deposits within the authorities debt markets, highlighting the controversy on Wall Avenue over the route of rates of interest.

On one facet is Financial institution of America, the second-biggest US lender by belongings, which helped enhance its third-quarter revenues by raking in curiosity from a debt safety portfolio that has grown 77 per cent over the previous yr and now stands at almost $970bn.

On the opposite is JPMorgan Chase, the largest US financial institution, which sits on an funding securities portfolio smaller in dimension and is extra inclined to park deposits on the Federal Reserve than squander them on probably overpriced Treasuries or company securities.

The divergent methods added a word of discord to an earnings season by which the main banks all benefited from a dealmaking increase on Wall Avenue — and will assist decide which lender is extra worthwhile on the opposite facet of the Covid-19 pandemic.

“You’re seeing banks taking varied methods surrounding their steadiness sheet and interest-rate administration,” stated Jason Goldberg, financial institution analyst at Barclays. “Time will inform which is extra acceptable than the opposite.”

The dilemma for the banks is they’re struggling to make use of all of the deposits that piled up on their steadiness sheets as authorities stimulus and quantitative easing applications have been rolled out through the well being disaster.

Lending out the cash could be their most well-liked possibility. However mortgage progress has been sluggish as corporations have discovered ample liquidity within the bond markets and shoppers have paid down money owed on bank cards.

Shopping for Treasuries or mortgage-backed securities supplies banks with some yield however carries different dangers. If rising inflation results in increased charges, they must mark down the worth of bonds of their “accessible on the market” portfolios and they’d miss the chance to make use of their money for extra worthwhile lending alternatives.

BofA has responded by stepping up its bond shopping for within the final yr, and the transfer paid off handsomely within the third quarter. Regardless of a 3 per cent drop in loans, it stated on Thursday that web curiosity earnings jumped 10 per cent — in contrast with a 1 per cent improve at JPMorgan and declines of 1 per cent and 5 per cent at Citigroup and Wells Fargo, respectively.

“If banks are struggling to generate loans, which means they’re going to have to soak up extra securities,” stated Mark Cabana, head of US fee technique at BofA. “There may be anticipated to be an ongoing, very sturdy financial institution bid for Treasuries.”

Against this, JPMorgan has solely elevated the scale of its debt safety portfolio by 3 per cent up to now yr. At Citigroup and Wells Fargo, the rise has been 14 and 12 per cent, respectively.

Jamie Dimon, JPMorgan chief govt, has made it clear that he fears Treasury costs might fall. In his April letter to shareholders, he stated, “It’s laborious to justify the value of US debt.” A number of months earlier, he stated he “wouldn’t contact [Treasuries] with a 10-foot pole”.

The financial institution’s chief monetary officer, Jeremy Barnum stated on Wednesday it was nonetheless “blissful to be affected person” with its extra deposits however was prone to begin investing extra quickly.

Wells Fargo additionally signalled that it’s prepared to attend. The financial institution had began shopping for extra debt securities within the first half of the yr, however retreated to the sidelines as charges began to rise. In contrast with the second quarter, its funding portfolio held regular.

“Our view now’s that there’s extra . . . threat to the upside for charges within the close to to medium time period, and so we expect there’ll be higher alternatives to deploy as we glance ahead,” chief monetary officer Mike Santomassimo advised reporters.

Such warning has been pricey within the brief run. If JPMorgan and Wells Fargo invested their further money at 1.5 per cent they may improve pre-provision earnings by 7 and 5 per cent from what they reported within the quarter, respectively, in line with Barclays’ Goldberg.

But when charges transfer increased, Treasuries might fall out of favour with the banks, making a detrimental suggestions loop within the markets.

“The chance is as charges rise, their lending companies look rather more enticing they usually purchase fewer Treasuries,” stated Gennadiy Goldberg, senior US charges strategist at TD Securities. “So I believe the danger is definitely for the Treasury market.”

Further reporting by Joshua Franklin in New York

[ad_2]

Source