[ad_1]

The US overtook China because the world’s largest supply of bitcoin mining two months after Beijing banned crypto mining this yr, new information has revealed.

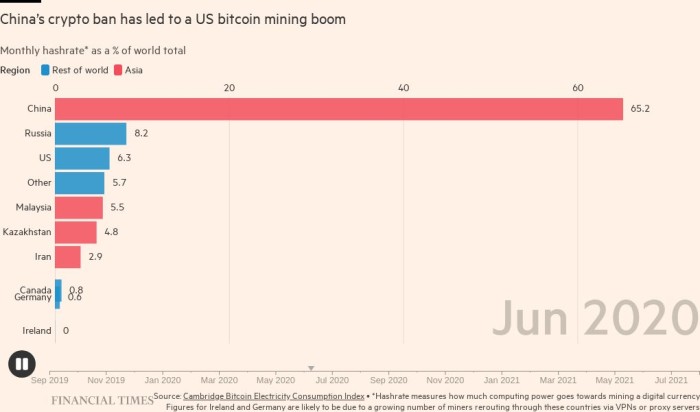

China’s share of the worldwide hashrate — the computational energy required to create bitcoin — fell from 44 per cent to zero between Might and July, figures printed by the Cambridge Centre for Various Finance on Wednesday confirmed. The nation accounted for three-quarters of the worldwide hashrate in 2019.

The US share of the worldwide hashrate elevated from 17 per cent in April to 35 per in August, whereas Kazakhstan rose 10 per cent to 18 per cent in the identical interval.

China’s State Council, or cupboard, banned cryptocurrency mining and buying and selling in Might, citing environmental and monetary considerations. The choice prompted an exodus of miners in quest of low-cost power and crypto-friendly politicians.

China’s bitcoin mining ban resulted within the “nice mining migration” mentioned Sam Tabar, chief technique officer at Bit Digital, a New York-based bitcoin miner. The corporate suspended its operations in China, which it had been winding down since October 2020, after the prohibition.

Michel Rauchs, digital belongings lead on the carefully watched Cambridge tracker, famous that “the impact of the Chinese language crackdown is an elevated geographic distribution of hashrate internationally”, including that it might be seen as “a constructive improvement for community safety and the decentralised ideas of bitcoin”.

Miners outdoors China loved a digital coin minting spree within the months following the ban, as Chinese language rivals scrambled to relocate their operations.

Beijing has since gone additional, labelling all crypto-related actions “illegal” final month, extending its prohibition to incorporate overseas operators.

China is rolling out its own digital currency, which authorities hope to trial on the Winter Olympics subsequent February in Beijing.

“The China shutdown has been nice for the trade and US miners,” mentioned Fred Thiel, chief government of Marathon Digital Holdings, a Las Vegas-based crypto mining firm.

“In a single day, fewer gamers have been going after the identical finite variety of cash,” Thiel added.

On common, 900 bitcoin are mined every single day by machines that race to resolve complicated computational mathematical issues that unlock new digital cash. Between July and September, Marathon Digital Holdings produced 1,252.4 minted cash, 91 per cent greater than the earlier quarter.

However Thiel mentioned that the competitors has intensified as Chinese language miners settled in to new areas, notably Kazakhstan. “We’re again to the place we have been earlier than the shutdown, so I count on the scenario to stabilise,” he mentioned.

However the scattered miners have additionally confronted roadblocks of their new houses, underscoring the challenges for digital forex corporations in figuring out predictable coverage environments as considerations mount about financial oversight of the sector.

Didar Bekbauov, cofounder of Xive, an Almaty-based cryptocurrency mining platform, mentioned that “instantly after the ban, Kazakhstan acquired plenty of mining machines, largely from Chinese language miners who needed to restart operations as quickly as potential”.

Authorities have blamed the exiled crypto hunters for latest energy shortages, slapping power-hungry miners with surcharges for electrical energy use. The Kazakh authorities additionally handed a cryptocurrency mining tax that can come into impact in 2022.

#fintechFT publication

For the most recent information and views on fintech from the FT’s community of correspondents world wide, signal as much as our weekly publication #fintechFT

[ad_2]

Source