[ad_1]

Evergrande Actual Property Group updates

Signal as much as myFT Every day Digest to be the primary to learn about Evergrande Actual Property Group information.

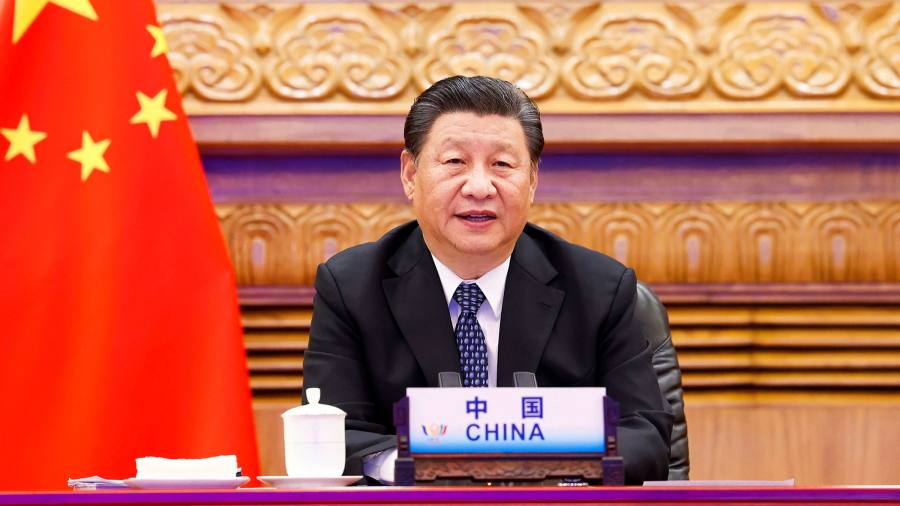

Only a yr away from an unprecedented third time period in energy, Xi Jinping is taking one of many largest financial gambles of his presidency by letting Evergrande teeter on the sting of chapter.

A collapse of the closely indebted Chinese developer would have grave penalties for tons of of 1000’s of property consumers and retail traders, in addition to monetary stability and financial progress on this planet’s second-largest financial system.

But Xi’s administration has but to supply any reassurances that it’ll intervene to stabilise the scenario, because it not too long ago did with two different giant conglomerates that nearly collapsed beneath the load of their vital money owed.

“Senior officers are very involved about Evergrande,” mentioned one authorities adviser, who famous that China’s debt-to-gross home product ratio had surged from 250 to 290 per cent in lower than two years.

“However it is just the tip of the iceberg,” he added. “If one thing actually dramatic occurs to Evergrande, the danger premium for different builders’ debt might be a lot larger, creating one other drag for the sector.”

After sharp falls in Hong Kong early this week, Chinese language markets had been comparatively secure on Wednesday as Evergrande said it would make an onshore bond cost due on Thursday. However the private-sector developer, based and led by billionaire Hui Ka Yan, gave no such reassurance about an offshore bond cost additionally due on Thursday.

Beijing has overseen a plethora of state-led restructurings of debt-laden teams not too long ago together with Huarong, the state-owned asset supervisor, and HNA, an aviation, logistics and tourism conglomerate. Evergrande, nevertheless, stands out due to its direct impression on the lives of hundreds of thousands of individuals throughout the nation.

Along with the estimated $300bn Evergrande owes banks, bondholders and suppliers, the group has issued greater than $6bn in high-yield wealth administration merchandise to an estimated 80,000 retail traders, together with its personal workers, who protested last week at its headquarters within the southern metropolis of Shenzhen. Homebuyers have pre-paid Evergrande for an estimated 1.6m flats that it has not delivered.

“That is going to be totally different due to the extra pressures that may come from extraordinary residents,” mentioned David Yu, a finance trade professional at NYU Shanghai.

The group is, by gross sales, the second-largest developer within the property trade that accounts for greater than 1 / 4 of Chinese language financial output. However as loath as Xi’s administration is to permit such a important financial engine to fail, additionally it is anxious concerning the very costly precedent it will set by organising a state-led bailout.

“Many builders are beneath stress due to coverage tightening,” mentioned one particular person accustomed to the group’s discussions with Chinese language monetary regulators.

“If the federal government steps in to assist Evergrande, all the opposite main builders will make comparable requests. There isn’t a means the federal government can save all of them.”

If Xi and his financial group do determine that the state should intervene at Evergrande to forestall a a lot bigger market and financial meltdown, one essential political problem might be methods to save the group with out essentially saving Hui, its founding chair.

Final month, Xi launched a domestic policy agenda that may deal with “widespread prosperity”, a central plank in his bid for an unprecedented third time period beginning on the finish of 2022 as head of the Chinese language Communist occasion. Rescuing Hui, China’s fifth-richest man, doesn’t match with Xi’s imaginative and prescient of a extra equitable society.

Hui controls greater than 70 per cent of Evergrande. The Hurun Report estimated his fortune to be price $35bn on the finish of 2020. Whereas Hui’s internet price will take an enormous hit after an 86 per cent fall within the group’s share worth over the previous 12 months, he has reaped billions of {dollars} in dividends over latest years.

“A wholesale bailout is just not probably,” predicted Larry Hu, chief China economist at Macquarie. “Shareholders and lenders may take an enormous loss. However the authorities will be sure that pre-sold flats get delivered to homebuyers.”

The federal government adviser mentioned that Beijing’s strategy with HNA, which had money owed of greater than $75bn, provided one potential mannequin for methods to deal with Evergrande.

HNA’s chair was sidelined by a authorities appointee who then reorganised the conglomerate into 4 distinct models and located a state-owned white knight investor for its best-known asset, Hainan Airways.

“The corporate would survive however they’d push out management,” the adviser mentioned. “That’s what occurred with HNA. It stabilised the corporate, its share costs and bond costs. Officers have loads of confidence on this strategy.”

[ad_2]

Source